Thoughts from the Desk of Bob Repass…

With the first pick in the 2018 NFL Draft the Cleveland Browns select…

And with those words this year’s NFL Draft was underway a few days ago. I have always been a “draft nerd” trying to forecast who each team would and should take. The more I dig in and research what I think will happen, the more I realize that the draft is actually all about the vetting process.

What exactly is vetting you ask? The dictionary definition is:

Vetting: Formal process and thorough examination (usually by an expert) prior to granting of approval or clearance.

It is the job of all the teams in the league from the owner, General Manager, Scouts and Coaches to exam and vet each potential prospect to determine who best fits their system.

A vetting process is an integral part of a successful note investor as well. It is imperative that you thoroughly vet three key components: counterparties, investors and vendors.

Let’s start with counterparties. In this situation the term counterparties refers to buyers and sellers. Who are you buying assets from? Who are you selling assets to? Have you vetted the sellers that you are looking to buy assets from? Here are a few basic things to keep in mind. Are you dealing directly with the actual seller (owner) of the assets or are you dealing with broker or “agent” of the seller?

The most successful note investors deal directly with the note seller as much as possible. Of course, brokers play a key role in this business as well and should be vetted as well, but be cautious of a broker that represents himself as a seller when in fact they are not.

Have you vetted the counterparty you are selling assets to? Is it an institution or capital fund or is it an individual? Are they using their own funds or relying on someone else’s money? If it is an individual do they actually have the money to buy the asset? Should you request a proof of funds letter? Probably not a bad idea, especially when it is a brand new relationship.

The second component that requires vetting in the note business is investors. In this case I am referring to capital partners. People you are joint venturing with when looking to acquire assets. The key factor to evaluate here is to make sure your investment strategies are aligned and each of your roles and expectations are outlined at the very beginning of the relationship. When I say outlined I mean “documented” and agreed upon in writing. Handshakes are great but they should be followed up by a written agreement to prevent any misunderstandings down the road.

The final component of vetting in our business is vendors. I cannot stress enough the importance of going through the process of vetting all the vendors you will be using starting naturally with the loan servicer.

Again this is all about aligning expectations and realizing sometimes it is just not a “good fit” and that is OK. Reviewing agreements and contracts that clearly lay out deliverables that the vendor is responsible for will go a long way to entering a relationship that will be beneficial to both parties.

My final words of wisdom when it comes to the vetting process is “Trust but Verify.” Regardless of which of these three components you are vetting, verifying the findings you have discovered during the process is the ultimate way to ensure that you should proceed.

Keep in mind, you can thoroughly vet someone and things can still go sideways down the road. But more times than not the team that properly vets the people most important to their business rise to the top.

To wrap things up, for those of you that do not know, the Cleveland Browns select Quarterback Baker Mayfield out of the University of Oklahoma with the first pick in this year’s NFL Draft which was a surprise to many “experts.” The pressure is definitely on the Browns organization to prove they properly vetted Mayfield and made the right choice.

Only time will tell…

Bob Repass

Managing Director

Stay up to Speed with Eddie

Double Your Closing Ratio Without Doubling Your Marketing Budget

by Eddie Speed

To a real estate investor looking to buy property, Plan A is to offer a low price and hope the seller takes it. But when the price of a property is too high for the buyer and the offer is not enough for the seller, they both walk away from the deal and nobody’s happy. In today’s tight market, only about one deal in twenty will close with that strategy, and most investors have no Plan B.

Or Plan C. Or Plan D. This is why so many investors are seeing such a low conversion rate in today’s bull market where properties are easy to sell but hard to buy.

When Plan A flops, the way to bridge the gap and make both sides happy is with Plan B: Get the seller to carry the financing for you – on YOUR terms – through creative seller financing. Adding this change to your toolbox is the tweak that could double your buys without doubling your marketing budget.

First, get it out of your head that seller financing is only for when you’re the seller. It’s also the perfect tool for when you’re the buyer!

Most investors make their offers based on price. But they need to learn how to make offers on terms. What I’ve discovered is that less than a tenth of investors can even wrap their mind around what that means. If price is Plan A, the world of terms is where you have Plans B, C, D – and as far down the alphabet as your knowledge and creativity can take you.

Two important parts of any seller financed note are the interest rate and the length of time to pay it off. As important as both of those are, they’re still only about 10% of the seller financing toolbox. I’ve discovered that most investors who even attempt seller financing as Plan B only understand this first 10% of how it works. It’s the only sauce they know how to put on their creation. The other 90% of seller financing options are made from other characteristics of the terms.

In the last few months, I’ve spent untold hours in interviews with investors, reviewing analytics, studying transactions, plus speaking at brain trusts and masterminds. It was a real jolt to realize that nobody really tries to figure this out or learn the full potential of seller financing. I can confidently say that when I teach a real estate investor how to do this at an advanced level, I can double their closing ratio.

The more you understand about the other 90% of tools in your toolbox, the more creativity you’ll have at bridging the gap between buyer and seller. This will benefit you two ways: You’ll close more deals, and you’ll get more good out of the deals you close.

What are some of the other things inside that 90% you need to learn about?

- You could do a subordination agreement.

- You could divide the note into partials, with a first and a second, then sell the first to cover your down payment.

- You could sell the first right of refusal to buy the note.

- You could offer an exchange of collateral in the security documents.

- You could move the mortgage on the house so it applies to another property.

- You could structure the deal so that the seller releases part of the collateral at closing based on the down payment.

- You could pass the lucrative terms from one investor to another.

- And like they say in the Ginsu Knife commercial, there’s more!

When you learn just how many options there are to work with in the seller financing toolbox, you realize nobody does seller financing to the Nth degree – they only scratch the surface.

Once you master the more advanced techniques of seller financing, it also opens up new possibilities for the properties you are targeting to buy. Such as:

- You could target heirs who have inherited property they don’t want to own.

- You could target sellers with vacant properties.

- You could target rental properties with tenants.

- You could find lists of people who have recently filed for divorce.

- You could find lists of free and clear properties.

- You could find lists of free and clear properties that are also vacant.

- You could flip a deal on a note for a quick payout.

BE MORE COMPETITIVE IN COMPETITIVE MARKETS

In today’s economy there are very few local “buyer’s markets” where you can scoop up real estate inventory at bargain basement prices. There are a few markets like that, but they have problems like high crime, no industry, or other troubles that aren’t likely to get fixed any time soon. Most investors don’t flock to these areas because even if they did buy a property at a low price they’d have a tough time unloading it in a depressed market. This is why investors tend to focus on healthier markets where property is in more demand.

Of course, healthier markets are the more competitive “seller’s markets” where sellers are holding out for top dollar. You’ll have to be smarter than the other real estate investors to close your deals – and by smarter I mean you’ll need to understand the full potential of seller financing so you can offer the price a seller is asking as long as you set the terms that benefit both yourself and the seller.

LEARN TO BE “ASSET AGNOSTIC”

This strategy works just as well whether the seller has total equity free and clear, or only part of the equity. And it’s not limited to only single family houses. It can be used on all types of properties in all types of situations.

Experienced real estate investors have learned to become “asset agnostic.” It means they’ve learned to recognize a good deal on whatever kind of property is involved. It doesn’t matter if it’s a big or small house, or vacant land, or a package of houses, or commercial property. Or if the seller is a married couple, or siblings, or old or young. Or if the property is local or across the country. A good deal is a good deal, and once you learn the deeper aspects of seller financing, you’ll be able to architect deals on pretty much any type of property so you can compete with anybody on anything.

LEARN TO DISCERN BETWEEN A SELLER’S NEEDS AND WANTS

You might think the most persuasive people are the ones who do most of the talking. But I’ve learned the most persuasive people are the ones who do most of the listening.

What if you were sick and went to see a doctor, then he walked in, handed you a bottle of pills, said take two a day, then walked out? You probably wouldn’t get cured, and you’d find a new doctor! A good doctor takes time to ask questions and listen to your answers to find out what your problem is so he can give you exactly what you need. There are no one-size-fits-all cures, so stop making one-size-fits-all offers on your deals.

Make every effort to talk to the seller before you submit your offer. Take them for coffee or offer to buy lunch. Not only will this help you craft an offer, but sellers often prefer dealing with people they know instead of dealing with strangers.

When you really listen to a seller, you’ll learn more about their situation and why the need to sell. Do they need long term income? Do they need out of a pricy mortgage? Did they inherit a property they don’t want? Are they retiring and want a smaller house? Are they moving to get closer to their grandkids? Are they getting divorced? Once you know why they need to sell and what they want out of the transaction, you’ll be able to craft a seller financed deal that hits all their hot buttons. By custom tailoring your offer to exactly what the seller needs and wants, you’ll have a huge edge over all the other one-size-fits-all offers from your competitors who didn’t take time to listen and don’t understand the creativity of seller financing.

WE HAVE A NEW CLASS COMING!

When fishermen get together, they tell stories of fish they’ve caught. When I get together with some of the top people in real estate, we tell stories about deals we’ve done. (And some of those stories are true!) One day I was telling them about when I was first getting started almost 40 years ago. I told them how I was flat broke with no money of my own to invest, so I had to put creative deals together to buy properties where I put up zero money of my own and the seller financed the deal. The seller got his money; it just wasn’t my money. I got the property and made money on the terms, too. Halfway through the story I looked around the room and noticed their eyes were bugged out and they were leaning in to hear better! That was a huge “Aha Moment.” The techniques I was using then – and have been perfecting ever since – are just what these investors were hungry to learn so they could close more of their own deals. That’s when the idea for a new class was born.

To help real estate investors learn the many advanced techniques in the toolbox of how to buy properties with seller financing, and architect those deals on their own terms, we’re creating a whole new class called: “Nothing Down Deal Architect – Buying Properties Using Creative Terms.” Here at NoteSchool, we’re all super excited because we know it’s going to help so many people boost their closing ratio to become more successful. We’re putting the final details and dates together, so please be watching your email inbox and our NoteSchool website to learn more.

If you want to double your closing ratio, you don’t want to miss this class!

Capital Markets Update

Spring Cleaning Your Investments

By: Ryan Parson

Spring is traditionally the time to clean the garage and to get the yard in shape. It’s also a great time to clean up your investment portfolio. Going into the final days of tax season, this is a perfect opportunity to get rid of clutter, review your asset allocations and make the necessary changes if your portfolio has strayed from your financial plan.

Here are seven steps to making your portfolio cleaner and more efficient.

Think of your investments as a portfolio

This is the first key step. Many investors focus on each individual holding and fail to look at the sum of the parts. Of course, it is important to invest in quality investments, both traditional and private. However, it can be more advantageous to start by determining whether your overall portfolio allocation is in line with your financial goals and risk tolerance.

Ideally, this should all be an extension of your financial plan. Even younger investors starting out should think in terms of their overall portfolio, even if it contains only a few holdings at this point.

Find your most recent statements and organize your records

Review all monthly, quarterly and yearly documents from your investment accounts. Keep them all in a paper file or on your computer and find a way to take a consolidated, overall view of your holdings as a portfolio. Categorize your portfolio by account and by asset class on a spreadsheet. This shows you how well-diversified you are across different asset classes.

Your spreadsheet might reveal an ungainly number of individual holdings across different accounts. That’s called financial clutter. This is common among investors who have a number of old 401(k)s from former employers. This makes your portfolio hard to track and monitor efficiently.

Consolidate your accounts

Decrease your financial clutter and consolidate your accounts as much as possible. Unless there is a compelling reason to leave an old 401(k) with a former employer, monitoring your portfolio is much easier if you roll the account into a consolidated individual retirement account or even your current employer’s 401(k) if allowed. Also, consolidate other accounts such as IRAs, taxable accounts or annuities from various companies.

Review your financial plan

Do this before reviewing your individual investments so your current allocation doesn’t distort your judgment. It is very important that you have a financial plan in place before you decide on an asset allocation strategy. The financial plan should drive your investing activities, allocation and choice of investments. A well-constructed plan helps you focus on your risk-tolerance and your goals for the money you save and invest.

Review your current investment holdings

Establish a monitoring process for your individual holdings, and review them against appropriate benchmarks on a regular basis. If needed, make changes as you see fit.

Rebalance your portfolio

After you review your allocation across all of your various accounts, you can buy or sell holdings or add new investment dollars to get back in line as soon as possible to ensure that it is consistent with the risk and return targets in your financial plan.

Establish a regular process to review and monitor your portfolio

Getting your portfolio in shape just once does no good if you don’t establish a process for reviewing your portfolio and your holdings on a regular basis. This doesn’t mean looking at your investments daily or even weekly. Doing so can only make you antsy about your investments, which often leads to bad decision-making.

Monitoring and rebalancing your portfolio quarterly or semi-annually is sufficient for most investors. Revisit your portfolio allocation and tweak your financial plan annually to ensure that everything is in sync.

Finally, make sure you have a financial power team at least reviewing your assumptions and decisions alongside you. Doing so can provide you peace of mind – so you can sleep better at night.

In The Spotlight

Last Call for the 2nd Annual Seller Finance Coalition Fly-In

This is your last chance to register to take part in the 2nd Annual Seller Finance Coalition’s fly-in in Washington DC May 9th & 10th! We will be back on Capitol Hill to gain support HR 1360 The Seller Finance Enhancement Act. Please plan on joining us! We need you there!

Register now to be a part of the 2nd Annual SFC Fly-In on May 9-10, 2018!

Quote of the Month

“It is a capital mistake to theorize before one has data.” – Arthur Conan Doyle

This Month’s Poll Question

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?

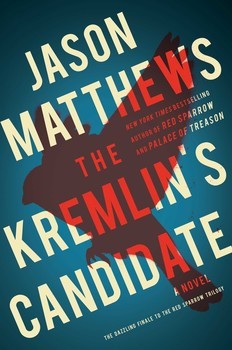

"The Kremlin's Candidate" by: Jason Matthews

Back in March I recommended seeing the movie Red Sparrow which was based on Jason Matthews’ first book in his three part series based on CIA’s recruitment of a spy inside the Russian Government. The Kremlin’s Candidate is the final installment in this saga and it does NOT disappoint! It is action packed and full of dark political intrigue and makes you as the reader sit back and wonder “can this really happen?”

"The Kremlin's Candidate" by: Jason Matthews

Back in March I recommended seeing the movie Red Sparrow which was based on Jason Matthews’ first book in his three part series based on CIA’s recruitment of a spy inside the Russian Government. The Kremlin’s Candidate is the final installment in this saga and it does NOT disappoint! It is action packed and full of dark political intrigue and makes you as the reader sit back and wonder “can this really happen?”