Thoughts from the Desk of Bob Repass…

When 2007 started, I was Managing Director of Bayview Financial and our operation was as we liked to say “blowing and going” buying millions of dollars’ worth of discounted seller finance notes each month. But then we all know what happened in mid-2007. Below is an excerpt of my “Thoughts From the Desk of…” column that appeared in the October 2007 issue of The Buyline.

As we all know, the market as we knew it took a dramatic change in mid-July. No one knows when or if it will return to “normal” but we have all had to adapt and change our business strategies to continue to succeed. Earlier this month, I sent the following quote to our Sales Team and asked each of them to tell me what they have learned over the past 90 days: “Learning is defined as change in behavior. You haven’t learned a thing until you can take action and use it.”

Each team member came back to me with well thought out responses on what they have learned and how they have adapted to today’s environment. Here’s an example of one of the responses I received: “I have discovered that adding value to each and every thing I do will lead to success. This market change has opened my eyes to this, and I realize that before our price may have been the biggest value to our customers. While price is still important, customer service, follow-up and relationship-building is now our value-add.”

Now as I sit here halfway through 2016, I look ahead at what we face in the coming months. Rising interest rates? Little to no job growth? Presidential and Congressional Elections. A divided Country? It brought to mind that we all need to constantly be prepared for whatever market changes may occur, so we are in a position to respond and adapt accordingly. So always be thinking – what is your “value-add?”

Now as I sit here halfway through 2016, I look ahead at what we face in the coming months. Rising interest rates? Little to no job growth? Presidential and Congressional Elections. A divided Country? It brought to mind that we all need to constantly be prepared for whatever market changes may occur, so we are in a position to respond and adapt accordingly. So always be thinking – what is your “value-add?”

Bob Repass

Managing Director

The Trading Corner

Colonial Funding Group to Launch Online Note Trading Platform

by Bob Repass

Colonial Funding Group, LLC will launch a new note trading platform targeted at real estate and note investors looking to buy residential real estate secured notes online.

The Southlake, Texas – based company unveiled NotesDirect.com on Friday, June 3rd at a special invitation only event.

NotesDirect.com, created for buying real estate secured notes, will allow users to search for notes, manage offers and complete sales transactions online. In addition, NotesDirect.com will feature three acquisition options: Performing loans, Nonperforming loans and REO properties. NotesDirect.com provides online offerings where interested buyers submit qualified offers in a non-auction format that brings the note purchasing transaction online.

The platform is optimized for use on desktops, tablets and smartphones, according to Colonial Funding Group.

“We’re on a mission to make the experience of investing in real estate secured notes exponentially better for everyone involved,” said Colonial Funding Group’s Managing Director Bob Repass. “The transparency, efficiency and ease that our platform provides sets a new standard for our industry.”

MarketPulse

MarketPulse

My Biggest Takeaway from NoteSchool’s Summer Summit

by Kevin Shortle

As you are aware, we recently held our Summer Summit event. There are so many things that I could write about! We made numerous announcements of new products, services and vendor relationships. All of these items will have an impact on your note investments. Several of them are “game changers” but I wanted to focus on another item that I know had a strong effect on many, if not all, attendees.

I started to see the impact of this other item during the first lunch break. I had a new member who had run into a bit of a snag on a formerly performing note. As a new investor she was facing unchartered waters on a deal in Michigan. I introduced her to a more seasoned member and within minutes was able to refer her to the best attorney in that area.

It’s that willingness to share, help, cooperate and support other members that has a huge impact on the overall success of our entire membership base. This is that other “item” that I am talking about.

At the end of the first evening, I was talking with a Titanium Member who explained to me that over the years, he had been a part of many different investment groups but he had never been a part of one that was so knowledgeable and willing to help and share with other members. He went on to explain how valuable that is to him.

Socializing on the evening after the event, I was able to sit down with several members. The biggest item they brought up was how great it was to be able to network with so many like-minded people. New friendships were formed. Future business associates were created.

To me, this “asset item” was the biggest walkaway. This is why the live events are so important. There absolutely were new bonds built and existing ones strengthened. These relationships, along with expert guidance, will shorten your learning curve, lower your risk and increase your opportunities.

When it comes to success, Napoleon Hill said this:

“Harmonious cooperation is a priceless asset that you can acquire in proportion to your giving”

Thank you to all of you who were so willing to give your time and assistance to others. Congratulations to all of you who went out of your comfort zone and networked with as many people as possible. All of you will reap the benefits.

To see the full potential of your membership, do yourself a favor and attend as many live events as you can.

In The Spotlight

In The Spotlight

So, here you are – you’re a one person business. You have no subordinates, no co-workers to hang out with in the lunch room, no assistant, no Marketing Department and most importantly, no Payroll Department.

You don’t need to know about management practices since you don’t have anyone to manage. Right?

Not exactly – you have to manage YOU and the same principles that guide companies like General Motors should guide your business. When you work for yourself, the buck doesn’t stop here – it won’t even get “here” if you don’t make it happen.

Peter Drucker, commonly recognized as one of the foremost authorities on business management, once cited the following two concepts as basic to any business strategy:

- The greatest risk of all is the risk of doing nothing

- Opportunity is where you find it, not where it finds you

First decide where you want to go, then draw the map. Ask yourself these questions:

- How much risk am I willing and able to assume? Can I afford to be a note investor full-time? Am I willing to incur expenses for marketing, advertising, education to drive business?

- How do I want to pursue note buying? Full-time, part-time, in a strategic partnership with another note investor? What type of notes do I want to buy? Performing, nonperforming? What markets do I want to invest in?

- Do I have the resources and knowledge necessary? Have I established relationships with investors, vendors, servicers, sellers needed to succeed in the note business? Do I know how they work and what their guidelines are?

- How can I turn my weaknesses into strengths? I may be small, but can that be an advantage for me?

Clarifying your objectives, examining your opportunities and deciding up-front exactly what your risk tolerance is will not only give you a head start on the competition, but will also help you sleep better at night. The detours you encounter won’t turn into dead ends if you know exactly where you are going.

Capital Markets Update

Capital Markets Update

Who’s on your Team?

By Ryan Parson

Building a Great Team by Looking Beyond your Backyard

Last month we emphasized the importance of continuing your individual education as it pertains to your financial future.

This month, let’s talk about the team that supports you as you grow…

When it comes time to identify the players on your financial team, they aren’t necessarily going to be in your backyard.

Typically, we engage local insurance agents, bankers, accountants, even stock brokers. These professionals provide necessary services, and there’s often an added level of comfort with having someone from our community helping us

For many of us, however, there are key players who might not be local. These team members might include your retirement planner, your business valuation planner if you’re self-employed, and the individual who assists you in planning your alternative investments, the latter being my role for investors across the country. We go outside our local community for these advisors because of their specialized expertise.

The Hard Questions

I want to acknowledge upfront that building a winning advisory team can be a daunting process.

For example, it may be a struggle getting the hard questions answered…

Can I retire and when?

What’s really going on with the stock market? Should I invest in it?

What about real estate? Should I embark on it?

How long am I going to have to work?

Can I afford to send my kids to college?

What does passive income really look like and how do I create more of it?

Tough questions, yes, but precisely the ones we need answered.

If you haven’t gotten answers that satisfy you, it may be because you don’t have the right players on your team.

Further, you may not have the right network surrounding you, one that has ‘been there, done that’ and so can guide you based on firsthand experience.

What I do

Here’s one thing I do…

I have my own investment strategies, but I pose this question to potential advisors for my personal portfolio:

“Tell me about your own portfolio… what do you invest in?”

If they don’t invest using an approach that’s congruent with mine, it may be a challenge for them to connect with my mindset and approach to wealth building.

I’ve found that there are a lot of advisors out there who will tell me about what they can do for me… their degrees, their awards… but they may not be able to relate to my personal objectives.

It’s not their fault, but if they don’t have similar experiences and attitudes toward wealth and financial freedom, they may not be the right person for the team.

What’s your Plan?

As I said, building a great team isn’t an easy task. You’ll probably find that some of your advisors aren’t going to be local. My advice is to seek out the very best men and women you can, and look for ones who understand you and your objectives because they hold similar philosophies and bring relevant experience to the table.

Finally, a great way to vet advisors is to reach out to your personal network and ask for recommendations. But remember – interview several people before you decide.

My investor clients and I also work with a superb group of advisors, so please ask for any help you need as you build your own team.

Here’s to the team!

Quote of the Month

David Mamet’s Pulitzer Prize-winning play “Glengarry Glen Ross,” later film adaptation starring Al Pacino, Alec Baldwin, Jack Lemmon and Kevin Spacey depicting the lives of four salesmen famously declared “First prize is a Cadillac El Dorado… Second prize is a set of steak knives… Third prize is you’re fired.”

Survey Says…!

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?

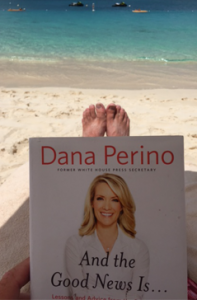

There’s nothing like digging into a great read on summer vacation. This summer why not relax, unwind and maybe even boost your career while your toes are in the sand. Here are three recommendations across the spectrum to tackle this summer.

”Lessons and Advise from the Bright Side” by Dana Perino: great book, quick read, perfect for poolside or on the beach. Life-lesson tips that are easy to apply to your everyday life.

The Old Man and the Sea by Ernest Hemingway: This is the perfect book to read in one afternoon. It clocks in at around 120 pages but stands the test of time as a tribute to courage, adversity, perseverance and personal triumph.

Foreign Agent by Brad Thor: Looking to escape? I’ve just ordered this book from Amazon and cannot wait to start digging into it. It is cast as “a brilliant thriller as ‘current as tomorrow’s headlines.’” Thor always delivers on action, intrigue and edge-of-your-seat suspense.

There’s nothing like digging into a great read on summer vacation. This summer why not relax, unwind and maybe even boost your career while your toes are in the sand. Here are three recommendations across the spectrum to tackle this summer.

”Lessons and Advise from the Bright Side” by Dana Perino: great book, quick read, perfect for poolside or on the beach. Life-lesson tips that are easy to apply to your everyday life.

The Old Man and the Sea by Ernest Hemingway: This is the perfect book to read in one afternoon. It clocks in at around 120 pages but stands the test of time as a tribute to courage, adversity, perseverance and personal triumph.

Foreign Agent by Brad Thor: Looking to escape? I’ve just ordered this book from Amazon and cannot wait to start digging into it. It is cast as “a brilliant thriller as ‘current as tomorrow’s headlines.’” Thor always delivers on action, intrigue and edge-of-your-seat suspense.