Thoughts from the Desk of Bob Repass…

I just returned from our Nation’s Capitol after three jam-packed days of lobbying on behalf of the Seller Finance Coalition. I was joined on my trip by Glenn Lee of Texas Funding, who is one of our Coalition co-founders along with Jeff Watson and Charles Tassell of National REIA.

The four of us covered 40 meetings with congressional offices, three meet & greets and combined to log in well over 120,000 steps according to my Fitbit!

The purpose of the trip was focused on the re-introduction of The Seller Finance Enhancement Act. As most of you know this bill was introduced late last year as bill H.R. 5301 with over 20 bipartisan cosponsors. Last Congress our Bill continued to gain momentum with the broad support of our many cosponsors while being considered as part of an overall Dodd Frank reform package. We faced a difficult climate with a divided government but continued to educate policymakers on the benefits of seller financing.

This session we hit the ground running by introducing the same Bill now known as H.R. 1360 in the beginning of March. Once again Congressman Henry Cuellar (D) and Roger Williams (R) both from Texas will be the lead cosponsors and they are joined by original cosponsor Andy Barr (R) from Kentucky.

Our mission was to obtain another bipartisan coalition of cosponsors consisting mainly of members of the Financial Services Committee. I am happy to report that we are well on our way to achieving this goal. We received numerous commitments on our trip and are following up on other potential cosponsors.

It is so exciting to have our bill reintroduced again this time to the new Congress along with an administration that is looking for meaningful regulatory reform.

What can you do to help? Please visit www.sellerfinancecoalition.org to join and support your investing business today. If you have supported us in the past, please renew for 2017. We have the momentum going and we need all the support we can get from all across the country.

Together we can Make Seller Financing Great Again because as you know there is nothing more American than Baseball, Apple Pie and Seller Financing!

Bob Repass, Jeff Watson, Charles Tassell, and Kristin Repass with Congressman Roger Williams, Congressman Brad Sherman, and Senator Mike Rounds

Bob Repass

Managing Director

Stay up to Speed with Eddie

Experience is the Best Fertilizer for Great Ideas

by Eddie Speed

Our saga to success was still chugging along in 1982, but was hardly in high gear. We had rented a two room office in Dallas. Martha was in the front room with our biggest investment to date: an IBM Selectric. (That’s a typewriter to anyone under 40.) I was in the back office with an extra chair for clients and a coffee pot.

To build our fledgling note business, we advertised in newspapers to reach a broad audience; running classified ads plus display ads in the business section. Our strategy to find qualified, seller-financed note investors was the shotgun approach, hoping to connect potential note buyers and sellers. But qualified note investors were rare as hen’s teeth, and really hard to find back in 1982. Our ads only brought in a trickle of clients. When we finally landed a customer, they would bring us their documents and we would connect them with a buyer. We spent a lot of time ordering appraisals, titles, surveys, etc.

The one thing every note always had in common was the Security Agreement (also known as the Deed of Trust, and simply called a mortgage in some states). It was the common denominator that put a lien against the property for whoever lent the money.

On the back page of every Security Agreement were the same exact words: “After recording, return to: ________________.” The note owner’s name and address would be written in the blank, then once the clerks at the county courthouse had recorded the agreement into the public records, the original copy was mailed back to the owner whose name and address were on the back.

Even though I was still a greenhorn, I must have seen the back page on hundreds of these things. And instead of jotting down all the names and addresses for Martha to type into our records, I just showed it to her to save a step. I like to think I was being efficient, but lazy was more like it.

It only takes five minutes to come up with a great idea, but you never know which five it will be. One day I was driving home from work and an idea hit me. The names and addresses of every seller-financed note owner would be recorded in the public records at the courthouse! And all those publicly recorded note owners were potential clients for me. Other businesses can hide the names of their customers, but my potential customers were a matter of public record.

Of course, this was before any of these records were digital, or searchable online. They were written into enormous, leather-bound record books at the public records building in downtown Dallas. So that was where I headed first thing the next morning.

I walked up to a chain-smoking, gray-haired lady with cat-eye glasses on a chain around her neck sitting behind the counter. I put on a full-press, Southern charm offensive, and I laid it on thick! I told her I needed to check some records, but there was no need for her to do anything besides point me in the right direction. It worked!

I slid one of those massive, dusty, record books off the shelf, plopped it onto a table, and started searching every entry. Most of the recorded loans were in a bank’s name, but I furiously wrote down every seller-financed note owner’s name and address I could find. I was finally fishing in the pond where the fish were. It was a gold mine of potential clients.

I changed my advertising strategy from running newspaper ads for a broad audience to sending out direct mail to a very select audience. I switched from the shotgun approach to the rifle approach!

This method for finding clients was uncharted territory, plus it was slow, tedious work. It could have been one of the 99 ideas I tried that didn’t work. But this one worked in a big way.

I didn’t realize it at the time, but I was the first guy in the country to use public records to compile a mailing list of people who owned seller-financed notes. The first time I tried it was in 1982, and by 1992 I had a coordinated system with a hundred courthouse researchers all over the U.S.

I never would have come up with this idea in the first place if I hadn’t been getting my fingernails dirty in the business every day and recognized a pattern. I was a young, aggressive guy practicing the trade, but certainly not an expert back in ’82. (I would have loved to be able to go to NoteSchool, but NoteSchool didn’t exist yet.)

Experience triggered my creativity, and the same thing can happen to you. Without experience you’re not looking through the right lens. By thoroughly knowing your business, you’ll recognize opportunities and trends that others won’t see.

Looking back on it now, that courthouse method is very antiquated. It was slow and time consuming. Today in 2017, we have far more efficient, scalable ways that use technology to locate potential clients. Even though I don’t recommend the courthouse method today, it worked then. It was a great idea, but like most great ideas it had a limited shelf life. You can’t keep relying on old ideas – you always have to keep your mental wheels turning to generate new ideas.

I hate to toot my own horn, but here goes. With over 37 years of buying seller-financed notes, I’ve either initiated or perfected the top 2 or 3 ways of sourcing notes.

I’ve had a lot of ideas over the years, and I admit most were pretty lame. But I can honestly say that I’ve never had a GOOD idea that wasn’t rooted in experience.

I’ll leave you with this last piece of advice: Don’t just learn the tricks of the trade – learn the trade!

Keep your wheels turnin’,

Eddie

MarketPulse

The Magic Penny

by Martha Speed

If you were given a choice to receive a million dollars in one month or a penny doubled every day for 30 days which one would you choose? Most of us would quickly take the million dollar!

If you could double a penny every day for 30 days the calculations would look like this:

Day 1: $.01

Day 2: $.02

Day 3: $.04

Day 4: $.08

Day 5: $.16

Day 6: $.32

Day 7: $.64

Day 8: $1.28

Day 9: $2.56

Day 10: $5.12

Day 11: $10.24

Day 12: $20.48

Day 13: $40.96

Day 14: $81.92

Day 15: $163.84

Day 16: $327.68

Day 17: $655.36

Day 18: $1,310.72

Day 19: $2,621.44

Day 20: $5,242.88

Day 21: $10,485.76

Day 22: $20,971.52

Day 23: $41,943.04

Day 24: $83,886.08

Day 25: $167,772.16

Day 26: $335,544.32

Day 27: $671,088.64

Day 28: $1,342,177.28

Day 29: $2,684,354.56

Day 30: $5,368,709.12

It’s like a magic penny! I really like the story of the magic penny and how it multiplies quickly when invested daily. You should be applying this concept to your IRA. The magic penny in your IRA is what I would consider short term gain. I’m always trying to think of creative ways to make money in my IRA every day. It doesn’t have to be a “home run” or big gain even though those are great. I need to close as many deals as I can to earn short term income and then reinvest the income in transactions that will have a big upside in long term gains.

For example, one of these may be options, which is a quick way to make money. When you option a property or note and sell the asset to a third party your IRA makes a fee without funding to acquire the asset. Options are usually sold to a third party “cash” investor and close fast which generates quick income or short term gain to reinvest immediately. If you multiply these types of investments up front in your IRA it gives you the extra money to invest in transaction that will give you more income for the future in long term gains.

Buying full and selling short or what we refer to as selling a partial is another way to make money in your account today and still reap the benefits of long term gain as well. If you have investors lined up to acquire the partials, the transactions can be closed quickly and generate short term income for your next acquisition plus the upside of the residual or long term gain, Tax Free!

Right now there is a high volume of activity in the Note business. Take advantage of it! If you doubled your efforts to close more deals in a short timeframe, how much increase in the liquidity would you see in your IRA to be reinvested?

In The Spotlight

A Great 2 Part Series Webinar on How to Value a Performing Note

Capital Markets Update

Capital Markets Update

What Role Can IRA’s Still Play for Wealthier Families?

By Ryan Parson

Taxes are unavoidable. How much we pay, however, is at least partly up to us.

Did you know that over 25% of the revenue the average American household earns goes to taxes of some form? This includes sales tax, property, luxury, estate, use, and income taxes and the list goes on and on. The bottom line: the amount of our income that goes to taxes is substantial.

If we don’t find a way to mitigate as much of our tax liability as possible, it means we have fewer financial resources to do what we enjoy, including investing. There are many avenues the IRS allows us to utilize.

One pillar of a sound financial management is to be as tax efficient as possible, and Self-Directed IRAs (SDIRAs), especially Roth IRAs, can be great options for doing that.

Sidebar: We know from many of our more experienced readers that you’re active with Self-Directed IRAs, but new families come to us and don’t realize that with SDIRAs they can invest in both traditional and, especially, alternative investments such as private debt/lending, private equity, and real estate. This is precisely the strategy that many of the wealthiest families use to mitigate their exposure to taxation.

IRAs? But Wait, Don’t I Earn Too Much To Contribute to an IRA?

Great question!

Many investors aren’t aware of the fact that even high net worth families can contribute to IRAs. I’ve been discussing this topic of late with accredited investors whose income exceeds the level that allows them to contribute to an IRA and receive a deduction.

However, what is still allowed in that case is making a nondeductible contribution to a Traditional IRA.

So contributions to a Traditional IRA aren’t tax-deductible, true, but your account does still grow, tax-deferred.

Traditional or Roth IRA?

OK, now that we’ve established the possibility of contributing to an IRA even if you’re over the income threshold, let’s consider the “Traditional IRA vs. Roth IRA” question…

As a quick reminder, the main benefit of both Traditional and Roth IRAs is that earnings grow, tax-deferred. In a Traditional IRA, you pay tax when you take distributions from the account. Roth IRAs are different.

The main advantage of a Roth IRA is that any distribution that you take past the age of 59 1/2 will be 100% tax free. You don’t, however, get the deduction off of your taxes when you make the contribution.

For accredited investors choosing to invest in higher-yield, risk-adjusted alternative investments, having that type of investment opportunity inside a tax-deferred account that additionally allows for tax-free distributions may be well worth exploring.

Again, you may be thinking, “But don’t I make too much money to contribute to a Roth IRA?” This is a very common response I get from high net worth investors. It may be true that you make too much money to contribute to an IRA and get a deduction on the money going in, but as I’ve said, you can still contribute to a traditional IRA, which then, can be rolled over to a Roth IRA.

There are certainly some extra steps to go through to get your money into a Roth, but my main point here is that just because you’re a high net worth investor, doesn’t mean you can’t have a Roth IRA.

How About Direct Contribution to a Roth?

Yes, that’s also possible if you earn less than $118,000 if you’re single, or $186,000 if you’re married and filing jointly.

There is still a lot of room to make a contribution directly into your Roth IRA which will allow you to skip the steps of making a traditional IRA contribution.

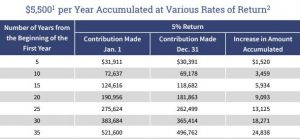

For 2017, this amount is $5500 per year or $6500 per year, if you’re 50 years or older.

So if you thought you weren’t eligible to take advantage of the benefits associated with the Roth IRA, please think again.

The Working Spouse Add-on

Additionally, another common opportunity often lost with accredited families is that the working spouse is able to make a contribution to the non-working spouse’s IRA.

Did you know that you can make a contribution of $11,000 to each of your non-deductible Traditional IRAs if you are under 50? You can also convert to the Roth IRA before you make an investment. Once that’s occurred, you and your spouse can then use the Roth to make your actual investment. And so, if you once thought that you weren’t eligible for an IRA, think again. If you thought that about your spouse as well, think again.

When structured right, these tax-advantaged vehicles can be extremely powerful to your wealth accumulation goals.

The Added Power of New Year Contributions

The power of making your contribution at the beginning of the year is an additional consideration.

It’s true that up to April 15th of the following calendar year, you can still contribute for the prior year. But what would it look like if you made your contribution on Jan. 1, 2016, rather than April 2017?

Even with investors who diligently contribute to their IRAs, I’m surprised to see many of them waiting up to sixteen months to make their contributions. We all know what the time value of money is. The longer you let it work for you, the greater the growth of the account.

As you can see from the graph above, there’s quite a long-term benefit to making your contribution at the beginning of the year. When you take advantage of this inside a Roth IRA, you’ve just further magnified the benefits of creating tax-free income in the future.

If you haven’t considered possible IRA strategies in a while, perhaps it’s time to visit with your power team, and now may be a good time to do it while we’re relatively early into 2017.

Here’s to smart investing!

Quote of the Month

“The key is in not spending time, but in investing it.” – Stephen R. Covey

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?

This month I am proud to introduce a guest columnist for our monthly Recommended Reading my daughter Kristin. As she readily admits below – she is not an avid reader but she is starting!

For the Lent season this year, I decided to read Killing Jesus by Bill O’Reilly and Martin Dugard. Killing Jesus is not a religious book, but instead one that focuses on the humanity of Jesus and the historical events surrounding this time. O'Reilly and Dugard do an excellent job of weaving together familiar facts we know with new material and providing the historical and cultural context to present a full picture of the world around Jesus. I admit I have not been the biggest reader in the past; however, this book was very readable and enjoyable, and I’ve already bought a new book to begin reading.

This month I am proud to introduce a guest columnist for our monthly Recommended Reading my daughter Kristin. As she readily admits below – she is not an avid reader but she is starting!

For the Lent season this year, I decided to read Killing Jesus by Bill O’Reilly and Martin Dugard. Killing Jesus is not a religious book, but instead one that focuses on the humanity of Jesus and the historical events surrounding this time. O'Reilly and Dugard do an excellent job of weaving together familiar facts we know with new material and providing the historical and cultural context to present a full picture of the world around Jesus. I admit I have not been the biggest reader in the past; however, this book was very readable and enjoyable, and I’ve already bought a new book to begin reading.