Thoughts from the Desk of Bob Repass…

This month I want to tackle the subject of risk management. Risk management is not the same as risk tolerance. Risk tolerance is more in line with your investment philosophy, as far as how much can you “stomach” large swings in the value of your investments.

I see many times when someone’s inability to determine their tolerance leads to inaction, also known as paralysis of analysis. Paralysis of analysis is when you sit on something until its “perfect” and you end up missing a lot of opportunities.

“Decisiveness: There are risks and costs to a program of action, but they are far less than the long-range risks and costs of comfortable inaction” – John F Kennedy

So what is risk management? As defined, it is the process of analyzing exposure to risk and determining how to best handle such exposure. In today’s market environment, it’s more important than ever to identify and evaluate risks, and then select and manage techniques to adapt to such risks.

It has become mandatory that potential risks are evaluated up-front rather than waiting until an asset defaults and loss mitigation begins. It is imperative that pricing models “predict” the level of risk prior to purchasing the asset.

Keep in mind there are clearly some differences in risk management when looking at deals from a fund manager’s perspective as compared to an individual investor point of view based mainly on the sheer volume and scalability of acquiring and managing assets in their respective portfolios. With that being said, there are a few key factors that are consistent across the spectrum.

So what factors impact the risk of potential loan acquisitions? One factor is creditworthiness. While the credit score of the borrower is a definite indicator of the risk associated with the loan, it goes much further than just the credit score. The credit of the borrower is weighed along with the loan-to-value (real and emotional equity) and the seasoning on the loan (pay history) to determine the propensity of the borrower to pay.

The location of the property is another factor that also impacts the risk in several ways. While the first thought an investor may have is to avoid hardest hit and declining markets, a knowledgeable and seasoned investor knows how to evaluate the risks and mitigate those when forecasting costs involved especially in the case of defaults and pricing accordingly.

“Risk comes from not knowing what you’re doing.” – Warren Buffett

The investors who understand where risk belongs in their lives, both from a tolerance and management standpoint, will ultimately be successful.

Bob Repass

Managing Director

Stay up to Speed with Eddie

Introducing a New Way to Put Our Minds Together for Success: NoteProMastermind

by Eddie Speed

I’m driven to help people succeed. My mission is for people to do more than they think they can do. As an entrepreneur, I’m always working on new ideas that meet real needs, and I’m excited to tell you about a big idea.

As I’ve watched people start successful note careers over the years, I’ve learned that nobody develops the skills to succeed by being isolated from other successful people. The body and mind can be pushed past where you think they can go, but not on your own. When you spend time around other people who have overcome similar obstacles that you go through, then you’ll become more successful. The reason success rubs off on each other is because wisdom rubs off on each other.

I started NoteSchool back in the early 2000’s to help people succeed, and now for 2018 I’m excited to launch another new way to help you build wealth in the note business. It’s called NoteProMastermind. It’s a series of masterminds where note investors can come together and spend time not only with other note investors, but also with our executive team at NoteSchool and Colonial Funding group.

When I’ve attended real estate masterminds over the years, I was usually the only note guy in the room. Even though I picked up information about other areas of real estate, they really didn’t expand my knowledge of the note business because there weren’t any other note people there who had been further down the same road I was on.

I found these events helpful in some ways but not in the areas I needed guidance the most. So I started kicking this idea around in my head: Instead of doing masterminds where notes are a side issue, we should do them where notes are the main issue.

IVY LEAGUE LEVEL NOTE TRAINING AND INTERACTION

NoteProMastermind will be unique because our NoteSchool executive team will facilitate and be deeply involved. Our collective wisdom will be available to you, and the most junior member of my team has 20 years of note experience! You can’t have bought 3.5 billion in notes for 40 years and still be full of bull. All combined, we’ve got a few centuries of experience in the trenches of the note business. We know the cycles that the industry goes through, so we know what’s coming down the pike. We know the difference between hypothetical solutions and what actually works in today’s real-world market. We know the roadblocks to watch out for that you don’t even know are out there.

Note investing will be front and center in every meeting and every presentation. People will share their successes (and struggles) on sourcing investors, or software, or legal issues, or evaluating notes, or a zillion other things – but everything will relate directly to notes.

The idea is to bring people together in a forum to share their wisdom and express what they struggle with. Everybody is good at something and bad at something. There will be somebody at the meeting who has succeeded where you may have struggled.

It’s spontaneous, but guided. The facilitators of these events will have mega-experience, so there’s always a qualified referee in control.

Without good leaders, masterminds can become chaotic, out-of-control free-for-alls. And the attendees need to be evenly matched, or you’ll have one guy who sells 200 houses a year and another guy who sells 2 a year. But NoteProMastermind will be run by experienced leaders who know how to keep discussion focused. We’ll also closely scrutinize the people who attend, so that you’ll be sure to rub shoulders with an intimate group of people similar to each other.

Now, I know this isn’t the first mastermind ever focused on notes, but I can assure you these will be the best. I’m not just bragging when I say that our experience level and exposure in the industry is immeasurably bigger than anybody else’s. We are connected. We know vendors, services, accountants, attorney networks, and on and on. We know things that are highly specialized because we live the business every day as super busy note buyers. Whenever our team shows up at an industry trade show, we’re peppered with questions because people look to us for answers.

IF YOU SHOW UP, YOU GO UP

Every attendee will go up in front of the group of your peers based on your level of experience in real estate and note investing to explain what you do, where you are doing well, and where you could use some advice – where you’re crushing it, along with areas where you need help. Then we open things up for discussion so people who have overcome the same struggles can explain how they did it. As the creative juices start flowing you’ll probably get 4 or 5 tweaks you can make to crush it even more.

In order to maximize the benefits to all who attend, we will pay very close attention to who is allowed to enroll. We want to make sure a NoteProMastermind event is right for you and you’re right for it. Every event will have a vetted group of attendees. People can be sincere but sincerely wrong, so we don’t want poor advice being given out at our events.

These events don’t take the place of one-on-one mentoring, but there’s a lot of intellectual capital in the room at a NoteProMastermind event, so it’s a very efficient way to tap into a deep level of experience without being expensive or time consuming.

EVERYONE NEEDS A PLACE TO PLUG IN

People tend to think they’re information seekers, but they’re really relationship seekers. I can’t overemphasize the importance of being around other successful people to make yourself successful. A lone wolf won’t survive nearly as long as a wolf in a pack.

New gym memberships are high at the start of any new year. But come July, a big chunk of those new members will have long since stopped coming. The ones that tend to stick with it are the ones that plug in by joining a class, or making new friends, or hiring a trainer that guides and inspires them.

There will come a time in the life of every investor when things aren’t going well and it looks like a good day to quit. On any football or baseball team, what would the quit factor be if not for somebody saying, “Let’s keep going! We can win this!” We all get discouraged, and we all need encouragement. NoteProMastermind gives you a place to get plugged into the industry, and form lasting relationships with likeminded investors. It’s a place to get the encouragement you need to build tenacity.

If this sounds like something that you would like to learn more about, just email us at [email protected]. We’ll give you more information on event scheduling, where they’re located, and financial details.

Sometimes the best way to come up with an idea that genuinely helps other people is to look back at what you wish you could have had when you needed help. Well, NoteProMastermind is exactly what I wish I could have been part of decades ago!

MarketPulse

The Top 20 Housing Markets

To kick-off 2018 let’s take a look at the 20 hottest housing markets across the U.S. Thirteen of the 20 hottest housing markets in the U.S. in January were based in California according to a list of the Hottest Real Estate Markets in America compiled by Realtor.com, and topping the list was San Francisco, followed closely by the tech-hub San Jose.

The list is compiled based on the number of listing views in each metropolitan market, plus the number of days homes spend on the market before being snapped up by buyers

“A strong stock market run, new tax laws, and a government shutdown have given buyers and sellers plenty to digest as they come to terms with the new economic landscape and their personal situation,” said Javier Vivas, director of economic research at Realtor.com. “While the national picture remains largely unchanged, real estate remains more local than ever, and demand and supply dynamics are rapidly shifting across the country as the dust begins to settle.”

The seven “non-California” markets to make the list include: Colorado Springs, CO; Midland, TX; Denver CO; Dallas, TX; Columbus, OH; Detroit, MI and Boise City, ID.

| JANUARY RANKING | HOUSING MARKET |

| 1 | San Francisco, CA |

| 2 | San Jose, CA |

| 3 | Vallejo, CA |

| 4 | Colorado Springs, CO |

| 5 | Midland, TX |

| 6 | San Diego, CA |

| 7 | Santa Rosa, CA |

| 8 | Sacramento, CA |

| 9 | Denver, CO |

| 10 | Stockton, CA |

| 11 | Modesto, CA |

| 12 | Dallas, TX |

| 13 | Fresno, CA |

| 14 | Los Angeles, CA |

| 15 | Columbus, OH |

| 16 | Chico, CA |

| 17 | Oxnard, CA |

| 18 | Santa Cruz, CA |

| 19 | Detroit, MI |

| 20 | Boise City, ID |

Capital Markets Update

Investor Exuberance and the New Year

By: Ryan Parson

Today’s Well-Performing Stock Market: It’s a Trap

Along with the New Year comes a renewed dedication to meet financial goals. Combine that drive with a stock market seeing record highs, and you may be tempted to move your money out of your private investments and back into the market.

Not so fast.

Remember, you moved into private investments for greater diversity, more control over your wealth and, of course, continued growth in any market. Remember, also, that in 2008, the stock market was seeing record highs – then the bottom fell out (which, by the way, tends to happen every 10 or 20 years).

Fund managers and investment firms see today’s market as overvalued. They’re cautious. You should be, too.

Watch our special industry expert Webinar as we review your investment goals and help you grow your wealth, both short-term and long-term – no matter the market conditions. We’ll help you avoid temptation, stay on track and have a happy new year.

“Investor Exuberance: Are You Falling Into the Trap?”

In The Spotlight

Save the Date: 2nd Annual Seller Finance Coalition Fly-In April 24-26, 2018

Last year the Seller Finance Coalition’s 1st annual fly-in in July was a huge success! There were close to 40 attendees from all over the country on Capitol Hill for a day and a half telling the story of how seller financing can impact a consumer’s ability to become homeowners as well as its effect on stabilizing neighborhoods to over 65 Congressional Offices. We will be back on the Hill this April to support HR 1360 The Seller Finance Enhancement Act. Please plan on joining us!

Register now to be a part of the 2nd Annual SFC Fly-In on April 24-26, 2018!

Fly-in attendees work Capitol Hill!

Quote of the Month

“Perhaps you can’t quit your day job, and I understand that. But never, ever quit your day dream.” – Chip Gaines

This Month’s Poll Question

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?

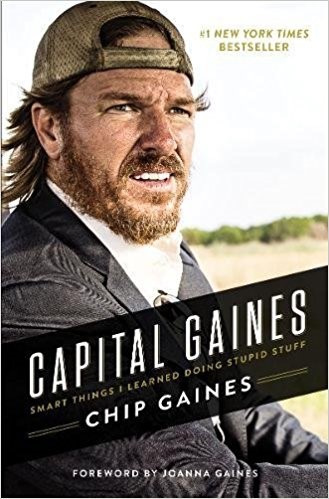

"Capital Gaines" by: Chip Gaines

This month I asked a very special guest, my wife Angie, to tell us about a book she recently read Capital Gaines: Smart Things I Learned Doing Stupid Stuff by Chip Gaines. Here’s her thoughts:

Chip Gaines, host of HGTV's Fixer Upper, reveals some of the ups and downs of his life, both personally, and as an entrepreneur. He shares his successes, but more importantly, his mistakes along the way and the lessons he learned from those mistakes. Chips' family is his number 1 priority. His business empire is number 2 and he is deeply committed to all on his team. Chip asks you to think about what motivates or fascinates you and then to "get after it".

"Capital Gaines" by: Chip Gaines

This month I asked a very special guest, my wife Angie, to tell us about a book she recently read Capital Gaines: Smart Things I Learned Doing Stupid Stuff by Chip Gaines. Here’s her thoughts:

Chip Gaines, host of HGTV's Fixer Upper, reveals some of the ups and downs of his life, both personally, and as an entrepreneur. He shares his successes, but more importantly, his mistakes along the way and the lessons he learned from those mistakes. Chips' family is his number 1 priority. His business empire is number 2 and he is deeply committed to all on his team. Chip asks you to think about what motivates or fascinates you and then to "get after it".