Thoughts from the Desk of

Bob Repass…

All real estate and note investors will ultimately come to a point where they need additional capital. The process of recapitalizing your portfolio typically brings two strategies to mind. You can sell your assets, i.e. a seasoned loan in your portfolio or a rental property, or in the case of notes you can sell a partial, the next 5-10 years of cash flow to a private investor.

Both of these strategies result in losing immediate cash flow. We all know how powerful it can be to leverage your cashflow which leads us to a third strategy to recapitalize which is to borrow money using your portfolio as collateral.

Many real estate investors do not understand how a note that you own can be used as collateral to obtain a loan. People easily accept the idea that a rental house is an income producing asset, so everybody knows that a loan can be obtained using the rent house as collateral. But a note is also an income producing asset, and there are lots of money sources who will be happy to give you a loan with your note as collateral.

Today’s uncanny and exciting times in the real estate and housing markets has steered Colonial Funding Group to announce the launch of our new Asset Based Lending program for Real Estate & Note Investors.

Our Asset Based Lending Program (ABLP) is designed to offer Real Estate Investors the opportunity to borrow money using their existing Note or Rental Portfolios as collateral for the loan. Our program offers loans starting at $200k.

Charles Mangan, our Senior Vice President at Colonial Funding Group is spearheading this program and has years of experience in this space. Throughout his career, Charles has assisted landlords who need to recapitalize by lending money against rental portfolios, land developers by lending against their seller financed note portfolios, as well as passive note investors by lending against their performing loan portfolios.

You can use our financing to unlock your existing equity, consolidate other debt or obtain additional capital to grow your business. Our loan products are flexible to meet your needs while providing you access to financing at a competitive fixed rate.

Now you can borrow money using your notes as collateral to buy more notes until you have an entire portfolio of income-producing notes to live on or retire on. Or you can bring them to us at Colonial Funding Group and sell them for a lump sum amount of money.

Recapitalization puts money back in your pocket and your portfolio!

Turn your existing portfolio into cash with an Asset based loan. If you would like to discuss how this program could benefit you, please feel free to reach with any questions. Email: [email protected] .

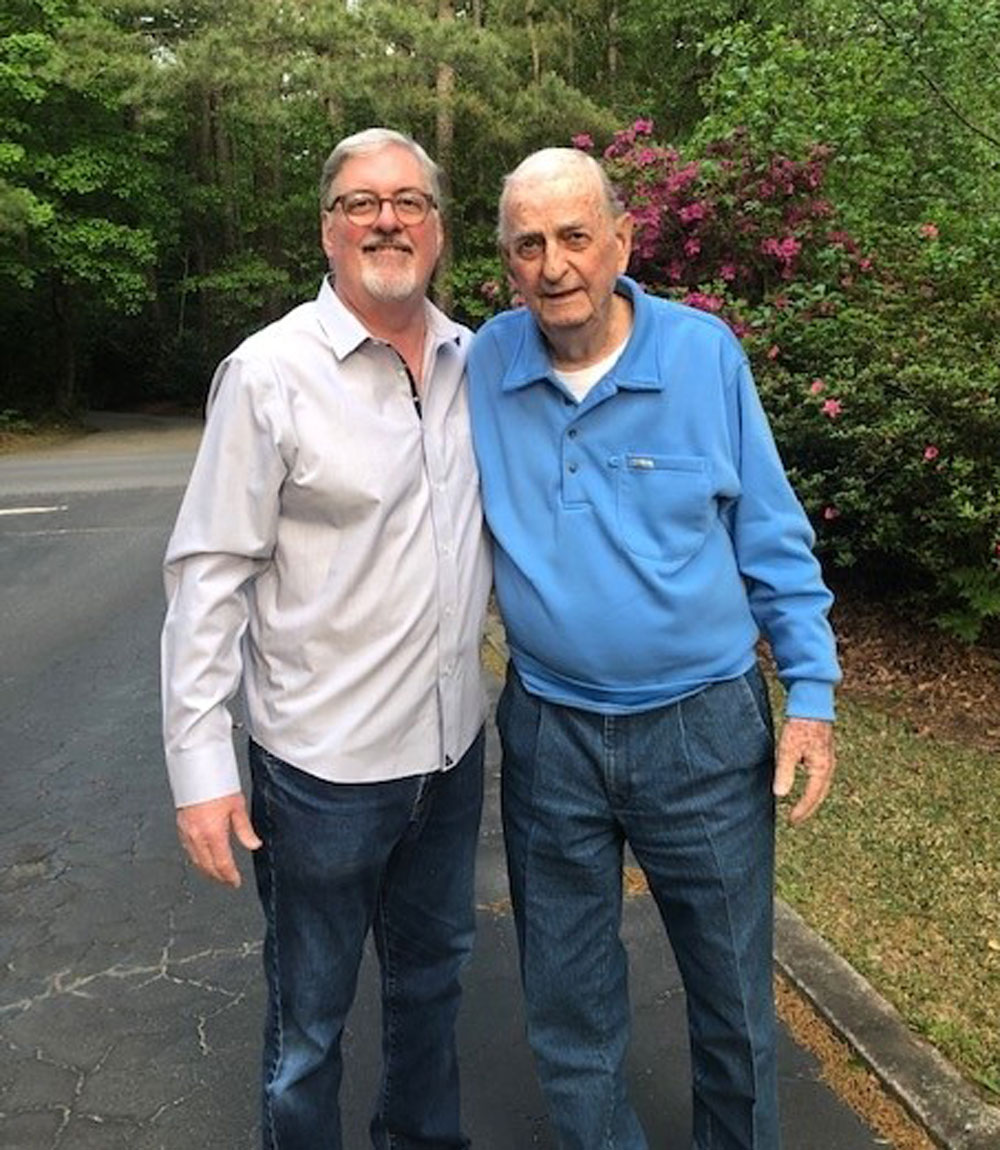

On a personal note, things continue to show signs of getting back to the way things “used to be.” Last month I was fortunate to be able to fly to North Carolina to celebrate my Dad’s 88th birthday. It was great to see him along with my brother and sister and their families. Wearing a mask on a 3-hour flight is a challenge but a small price to pay to get back to traveling!

Bob Repass

Managing Director

Stay up to Speed with Eddie

You Can’t Get Your Mindset Right If Your Facts Are Wrong

by Eddie Speed

I may not be built for dunking basketballs, but I know that the hoops are 10’ off the floor and anchored in place at each end of the court. But imagine if those hoops were constantly moving around and getting higher and lower throughout the game. That would sure keep things interesting!

Well, that’s kind of how the game of real estate is played. Profitability is a moving target!

The business is constantly changing and evolving. What worked last year doesn’t work this year, and what works this year may not work next year. Real estate investors have to frequently evaluate their efforts and change their strategies.

I go to lots of business meetings with many of the top executives in real estate.

Some of these folks are setting goals for 5 years, 10 years, and 20 years out. For me that’s hard! None of us know what twists and turns the future holds. I love the old saying, “How do you make God laugh? Tell him your plans.”

After being a note guy for forty years, I’m convinced that the note business is the most flexible and adaptable way to make money in real estate. When the market changes, you just change the way you structure notes. Creative financing can fill gaps traditional lenders can’t. We thrive on market inefficiencies. We can fill a void even when it’s a moving target. While other investors are biting their nails, we’re making deals!

But in spite of the ever-changing nature of the business, I want to describe one constant that never changes:

TO SUCCEED, YOU MUST HAVE THE RIGHT MINDSET

“Whether you think you can, or you think you can’t, you’re right.” This timeless quote by Henry Ford sums up what it means to have the right mindset.

The right mindset helps you avoid two extremes: From foolishly pursuing impossible goals, and from foolishly thinking you can never succeed. The right mindset keeps you balanced and grounded in reality.

Our emotions can play tricks on us. That’s why it’s critical to make decisions based on facts instead of emotions. My emotions might tell me I can dunk a basketball behind my back, but the facts tell me otherwise.

THE INGREDIENTS OF A PROPER MINDSET

I’ll give you my top two ingredients to a proper mindset that will continue to serve you well through the ups and downs of real estate investing.

First, you have to understand what’s possible and what’s impossible. (Notice I didn’t say what’s easy and what’s hard.) Aim at realism; not unbridled optimism or negative pessimism.

The second ingredient is: stone cold facts. If your facts aren’t right, your decisions won’t be either. (Come to think of it, if your facts aren’t right, they’re not facts!) If facts aren’t informing your decisions, then what is? Facts tell you what’s realistic and what’s not. Emotions and opinions can get you in deep trouble fast when it comes to investing. When you make decisions, try to think like detective Joe Friday from Dragnet: “Just the facts, ma’am. Just the facts.”

EVERYBODY HAS AN OPINION, BUT NOT EVERYBODY HAS THE FACTS

Most people see Colonial Funding Group as a financial institution, and NoteSchool as a training company; but we’re much more than that. We’re a news source. We’re your Fact Headquarters—a well of truth in a desert of misinformation. I have lots of people on staff who have their noses buried in market data from multiple sources all day long. That’s how we find insights and emerging trends that won’t be on other people’s radar for a long time. It’s how we make data-driven decisions on what is possible and what’s not. We constantly share those findings with our NoteSchool community, so make sure you stay connected.

I feel safe in saying that you’ll get more accurate financial information from us than from lots of big name news sources on what’s coming down the pike. Speaking of which, I just read an article from a top newspaper. Their article said the same things I’ve been telling you for over a year, but they declared their findings like it was “hot off the presses.” Gimme a break!

Everybody has an opinion, but not everybody has the facts.

I love the famous quote by Michelangelo: “The problem human beings face is not that we aim too high and fail, but that we aim too low and succeed.”

If you get your facts straight, aim high, and take your best shot, you’ll pleasantly discover that it is possible to hit a moving target!

Capital Markets Update

The Impact of COVID-19 on Retirement

By: Ryan Parson

COVID-19 & Retirement Unreadiness

The COVID-19 pandemic has been with us for more than a year and it’s probably no surprise that it is making pre-retirees worry that their long-term retirement savings is not enough for them to retire when they want. According to research, Fidelity puts “55% of Americans in the yellow or red, in danger of not fully covering even estimated essential expenses like housing, health care, and food in retirement.”

Fidelity color-coded retirement readiness as follows:

-

- Red means significant action is needed, as you are at less than 45% of goal

- Yellow means action is needed, as you are between 65 – 80% of goal

- Light green means you are on track, as you are between 80 – 95% of goal

- Dark green means you are comfortable, as you are at greater than 95% of goal

And Retirement Unreadiness is not just limited to one generation.

-

- Generation Y (born 1978 – 1988): 62% are in the yellow or red;

- Generation X (born 1965 – 1977): 58% are in the yellow or red; and

- Baby Boomers (born 1946 – 1964): 48% are in the yellow or red.

But COVID has Really Ratcheted Up the Worries

There are a lot of studies that document how the pandemic has impacted retirement savings, as many have had to tap into retirement accounts just to pay expenses.

And for those impacted by the pandemic, a retirement study by Wells Fargo found that 58% now say they don’t know if they have enough to retire because of COVID-19. Moreover:

-

- 70% say they are worried about how to make sure they don’t run out of money in retirement;

- 61% say they are much more afraid of life in retirement; and

- 61% say the pandemic took the joy out of looking forward to retirement.

What should you do if you are one of the 55% in the yellow or red? Or how can you be one of the 30% that is not worried about running out of money in retirement? Well, everyone is different, but the key is to make sure you have a plan to get there. And if you do have a financial plan, now is a good time to review it to ensure that you are still on track.

A CHECKLIST FOR YOUR RETIREMENT PLANNING

The time to begin planning for your retirement future really is now. It sounds trite, but when it comes to preparing for retirement, the earlier you start, the better. Here are some steps to help you achieve your retirement objectives:

-

- Review your current financial situation by assessing your income and assets versus your expenses and liabilities.

- At first, determine a realistic amount to contribute regularly to your qualified retirement plan, g., a 401(k) plan. Over time, try to maximize allowable contributions to your savings plan.

- In 2021, you can contribute up to $6,000 into a traditional Individual Retirement Account (IRA) or Roth IRA. If you are age 50 or older, you can contribute an additional $1,000. Depending on your participation in other qualified plans, contributions to a traditional IRA may be tax deductible. Earnings for both traditional and Roth IRAs have the potential to grow on a tax-deferred basis.

- Work toward reducing your debt. Pay off large bills as soon as possible. Curb your spending to avoid taking on any new debt that could carry over into retirement.

- Consult with a qualified professional about your life, health, and disability income insurance policies to determine the amount of coverage for your current and future needs.

- Find out how much you can expect to receive in retirement from pension plans, veterans’ benefits, or Social Security. To get an estimate on your future Social Security benefits, visit www.socialsecurity.gov.

- Analyze which expenses are likely to decrease after you retire (clothing, commuting, etc.) and which are likely to increase (medical, travel, etc.), and plan accordingly.

If you adhere to your checklist, you may see your savings increase as you get closer to reaching your retirement income goals. Remember, it is never too early to start planning for your future.

The Trading Corner

Push the Partial

By: Scot Tyler

By now you have purchased your mailing list of seller financed leads, sent out marketing pieces and now your efforts are finally starting to pay-off and your phone is beginning to ring from note holders. Call after call you are building rapport, gathering note information, filling out your submission worksheets and sending them to [email protected] to receive pricing on each of your leads.

After reviewing and running the quotes you received back from your investor you cautiously subtract what you believe to be a fair flipper fee for yourself. You then contact your note holder to deliver your offer for their note. You’re ready to make that phone call because you have done your due diligence on the property, the area, the buyer, the terms of the loan and have your plan of attack for delivering the offer set in place. You contact the seller and provide your full purchase offer.

Unfortunately, the note holder’s response is not what you were expecting. You get “thank you for the time but right now I’ll just hold onto the loan for now…” and you cannot believe it. Your call ends and you are left wondering what you did wrong and why the seller did not accept your offer. If you did not determine or understand the seller’s motivation/need then you missed out signing up that deal.

Without knowing what the seller’s need is, how can you create a purchasing option that is tailored to the note holder? The only thing the seller heard when you delivered the full purchase offer was a number much less than what was currently owed by the borrower and on top of that the seller may not have even needed that much money. He checked out and is moving on to other options.

If you are not pushing the partial, then you are missing out on deals. In the scenario above digging for the seller’s need/motivation keeps this deal alive. Rewind back to the original phone call with the note holder and figure out did you ask the questions to determine the seller’s need? Did you really try to determine what their cash needs were? Sometimes we get wrapped up in the numbers and the property that we look past their needs. The seller only needed $30,000 in order to satisfy his need. Without knowing this there is no way to structure a partial purchase that gets the seller the cash he needs and allows you to keep a deal alive and make a fee. After the many years of quoting note sellers, I have found if you are only offering a full purchase quote you dramatically decrease your chances of signing up that deal. The different partial purchase options have been significant in my success as a note buyer over the years.

On your next call ensure you are doing your best to determine the actual needs of the note seller. Create a purchasing option that is specific to their needs and you will see your sign-up ratio increase immediately. Many times, the note holders are not even aware that selling part of their note is even an option. It is our job to explain to the seller their options and the benefits of only selling a portion of the note to get their immediate cash needs and the advantage of retaining the interest in the remaining future payments. The seller remains vested in the loan which opens the door to sell more payments at a future date or hold onto the payments for future cash flow. Sharpen up on your partial skills and make sure you “Push the Partial” on your next call. You might be the only buyer offering such an option.

Here is a note that came across our trade desk that we recently funded. If you’re interested in purchasing it, email me at: [email protected]

Performing Loan – Single Family Residence – Owner Occupied

Amarillo, TX

BPO $210,000.00 – February 2021

$220,000 sales price with $10,000 down payment

$210,000 / 10.0% / $1,842.90 for 360 months

7 made / 353 left

Current UPB $209,333.22

Until next month.

This Month’s Poll Question

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?