Thoughts from the Desk of Bob Repass…

“UGLY, but we’ll take it!” How many of you have ever heard or said that mantra? Well as I sit here this morning finishing up this month’s issue of The Buyline, the final edition of 2016, I can say I said this as recently as last night. Why you may ask? Well as most of you know I am an avid Dallas Cowboys fan. In the spirit of full disclosure, our family has been season ticket holders since 1998 and to say we have seen way more downs than ups would be a major understatement.

But this season has been excitingly different! My Cowboys are sitting at 11-1 after last night’s shall we say UGLY win over the Minnesota Vikings. For the majority of the season we have watched the Cowboys play well above what we have seen in the past, and usually in a game like last night’s, we would’ve lost that game. But this year is different! We won, yes it was ugly, but we’ll take it. All great teams win games they should’ve lost, so we are encouraged after last night as we enter the last month of the regular season.

But Bob, what does this have to do with our business? As I was tossing and turning in bed last night winding down from the game, I realized that “Ugly, but we’ll take it” is something that throughout my 27+ years in the discounted mortgage and distressed debt space we deal with whenever we are reviewing and analyzing potential deals.

Our focus is on the low-value property band i.e. sub $125,000 properties and honestly one of the factors that an asset must pass is the “eyeball” test. What does the property look like? We realize we are not buying the Taj Mahal, but is there pride in ownership, what condition is it in, is it a blighted property?

As they say “beauty is in the eye of the beholder” and what we can live with may not match another investors appetite and that’s perfectly OK. But I feel I have been successful over my career by realizing some assets may be ugly, but we’ll take it anyway.

To borrow a phrase from one of my favorite television HBO’s Game of Thrones, “winter is coming” and I would be remiss if I did not take this opportunity to say that my wife Angie and I wish each and every one of you a Merry Christmas and a Happy Holiday season.

We are looking forward to a great 2017. Talk to you next year!

Bob Repass

Managing Director

The Trading Corner

Baseball, Apple Pie & Seller Finance

It’s been a month now since Americans went to the poll, and President-elect Donald Trump will be sworn in January 2017. Multiple news reports are stating he has declared that he will overturn large portions, if not all, of Dodd-Frank. I personally have seen a number of investors boasting about this on social media.

Beginning Sunday night and continuing into Monday morning, I spent several hours carefully reviewing the complex language in the Financial Choice Act, which is a likely favorite to be passed in Congress and signed into law early in January 2017 in order to drastically reform Dodd-Frank. The problem with that bill is that it does absolutely nothing for small real estate investors who wish to sell their properties via owner financing.

Even though the election has dramatically changed the landscape in Washington, D.C., it is more important than ever before that we as investors, agents and entrepreneurs become engaged regarding the Seller Finance Coalition. You can find out how to do that. If we do not have a seat at the table at times of great change so that our voices can be heard, we will be ignored or taken advantage of when changes occur.

In order to be able to get us to where we want to be with seller financing of approximately 24 deals per year (based upon the terms negotiated with the National Association of Realtors), we not only need major changes to Dodd-Frank, but we also need changes to the Safe Act and to certain Truth in Lending Act (TILA) guidelines.

H.R. 5301 does exactly that. It is important that you join the Seller Finance Coalition, and it’s important that you contact your members of Congress and ask them to co-sponsor and support H.R. 5301. National REIA has made it easy to contact your member of Congress on this issue. In my next email I will share that link to National REIA’s powerful resource.

Today, join the Seller Finance Coalition. Next, contact your member of Congress.

We must keep this effort going so we don’t lose momentum just as we’re getting so close to seeing the relief our industry desperately needs become a reality. Please join today.

MarketPulse

MarketPulse

Things to consider for Your Year-End Financial Checklist

by Martha Speed

The last few weeks of the year are always hectic and a mad rush to wrap up loose ends we didn’t complete during the year. With the end of 2016 fast approaching we like to share a checklist of important items to consider related to your investments and finances.

Is your money in a self-directed retirement account earning interest? Maybe you never got around to making an investment in 2016? Don’t let your investment dollars sit idle. Put your dollars to work, buy a performing note, invest in a partial with us, get your money working for you creating cash flow before the end of the year! Self-Directed Retirement Administrators agree Real Estate Secured Notes are one of your best investments to grow your account!

If you are over 50, you may qualify to contribute as much as $6,500 to an IRA or $24,000 to a 401K plan based on adjusted gross income. The 401K Solo and SEP IRA’s allows for the highest contribution levels if you qualify as a small business owner. Check with one of our preferred Custodians to determine your annual contribution limits and options.

Opening a self-directed retirement account by December 31, 2016 counts as 1 year toward the 5 year clock for tax free withdrawals on Roth IRA accounts.

You have until April 15th to make a contribution to an IRA which can be applied to the 2016 tax year.

Required Minimum Distribution (RMD)

Don’t forget to complete forms & instruct your custodian to pay Required Minimum Distributions on or before December 31 each year. The penalty for missing a required withdrawal is 50 percent of the amount of the distribution with the exception of the first year.

RMD is required for an inherited Roth IRA or Traditional IRA when you reach age 70.5.

If you turned 70.5 during the year, you are not required to take the RMD until the next year. However, if you wait until 2016 to take your 2015 RMD plus the RMD at the end of 2016, will this put you into a higher tax bracket?

Roth Conversion?

If you expect to keep moving into a higher tax bracket think about converting your Traditional IRA to a Roth IRA or open a new account before your pay scale increases.

Coverdell Educational Savings Account

This tax savings account can be passed down generation after generation.

2016 contribution is $2,000.00

If you have a high deductible health plan open a HSA. The 2016 Contribution is $6,750. per household plus $1,000.00 catch up contribution over 55.

Did you know you can use the money in your HSA to make investments? If you are at retirement age consider how much you will need for out-of-pocket healthcare cost after retirement.

The total contributions plus profit on investments can be distributed after age 65 tax free & penalty free for qualified medical expenses.

You may also make a transfer from a Traditional IRA to your HSA once in a life time.

Flexible Spending

Use it or Lose it. Flexible Spending is for medical expenses but must be used by year end with the exception of $500.00 which can be carried over to the next year.

Most importantly it’s the best time of the year to give of your time, money and talent to those less fortunate than yourself.

Happy Holidays to everyone! Wishing you a happy, healthy and prosperous new year!

In The Spotlight

There are a host of people behind the scenes that drive the engine to make our companies successful. As 2016 winds down, I would like to extend a very special Thank You to each and every member of our team. We are very fortunate to have a great team of employees. It is through their hard work and dedication that we have been able to have the kind of success we enjoyed this year. I am confident we have the very best people in our industry and I would like to recognize all of them this month.

Executive Team: Eddie Speed, Martha Speed, Bob Repass, Charles Mangan, Susan DeLaGarza and Ryan Parson

Executive Support Team: Debbie McMinn and Jeanna Clifford

Trade Desk Team: Angie Repass, Nathan Cheung, Ralph Marshall, and Mark Jamlech Santos

Asset Management Team: Linda Risk, Matthew Edwards and Wood Speed

Customer Fulfillment Team: Riley Goff, Jesse DeLaGarza and James DeLaGarza

Sales and Business Development Team: Duane Gibbs, Ben Haught, Kevin Moore and Rachel Suttles

Curriculum and Liaison Team: Kevin Shortle, Joe Varnadore, Czarina Harris, Ellen Katz, Sara Kranpitz and Melissa Newkirk

Capital Markets Update

Capital Markets Update

The Four Keys to Building and Managing an Alternative Investment Portfolio

By Ryan Parson

Several Key Elements are essential for a successful Alternative Investment Portfolio, but the elements for building and managing your Alternative Investment Portfolio are different than those for building and managing a traditional investment portfolio.

Key #1: Know Where (and How) to Look

Once you’ve made the decision to build an Alternative Investment Portfolio, knowing where and how to look for Alternative Investments is the first Key.

The alternative world is different from the traditional investment world in that you’re unlikely to turn on the TV and find an ad for alternative real estate, healthcare, energy or other forms of alternative investments. Unlike the mass-market products pitched by Schwab, Ameritrade, and Fidelity, you have to seek out Alternative Investments.

Since 2013, deal operators have been able to create websites to promote alternatives and unique investment deals. However, not all websites are created equal.

You may also have heard of crowdfunding as a way to raise capital for an investment. Crowdfunding platforms allow all investors, even those who aren’t accredited, to take advantage of certain investment opportunities. These sites typically promote a partial investment opportunity, and they usually provide some basic due diligence about the investment. Yet, when it boils down to it, the platform itself is really nothing more than a promoter.

There are also online portals that provide a higher level of service but require the investor to be more transparent about themselves. Usually, of course, providing more transparency applies mainly to the deal operator, not the investor. The reason for the switch in roles is that more discerning deal operators prefer getting to know their investors on a more personal level because they know that their success is based in large part on the relations they have with their investors. Seasoned deal operators and promoters typically want to know who they’re doing business with – just as an investor should.

Key #2: How Do You Know Which Deals are Best for You?

Found a promising opportunity? Great. Now it’s time to conduct due diligence about the deal itself to determine suitability for YOUR portfolio. Being able to do the right type and level of due diligence is a more challenging process in Alternative Investments than in traditional markets. When buying traditional investments, we usually rely upon recommendations of our stock broker or advisor or do a little online research. But what if you’re trying to do your homework on a tech startup or other private opportunity? It can become a daunting process to even figure out how to go about it.

Beyond the important question of whether the opportunity is sound, your decision also comes down to determining suitability for YOUR portfolio. It’s always good to measure an opportunity against your personal criteria before moving forward.

Key #3: You Made the Deal and Invested in the Opportunity… Now What? The Importance of Keeping Track of What You Invested In

Now that you’ve decided to pull the trigger and make the investment, what happens next?

With Alternative Investments, having the level of transparency into performance metrics you want to see can often be more difficult to achieve because there may not be enough information in place to support it. However, there are things that can be done by the deal operator to provide acceptable levels of information to you (as well as the frequency with which you receive that information). Those operators who are providing a high degree of transparency and access are often willing to accommodate your desire for regular updates.

Key #4: Monitoring the Appropriate Investment Balance in Your Portfolio

Just because an investment is doing well doesn’t mean it should continue to be part of your portfolio. For example, let’s say you’ve been investing in various types of alternatives for growth and you’ve realized that the nature of these investments isn’t producing the kind of cash flow (current income) you need. You’ve reached retirement, and you need more cash than growth potential. It may be time to liquidate and re-balance into other sectors of investments that can provide you with needed income. Keep in mind that it will be incumbent upon you alone to monitor your portfolio for suitability in the absence of an advisor well-versed in alternatives.

RECAP

All four of these Keys – 1) finding access, 2) selecting, 3) monitoring, and 4) measuring ongoing suitability – are critical to building and successfully managing an Alternative Investment Portfolio.

Quote of the Month

“Stay the course. When thwarted try again; harder; smarter; Persevere relentlessly.” – John Wooden

Survey Says…!

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?

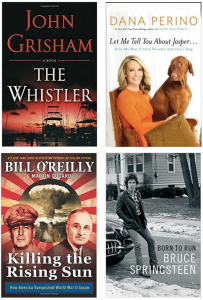

Being the avid reader that I am, I usually find myself this time of year making a list of books that I would like to read in the coming year. This makes it easy for my family members when they are trying to figure out “what to get Bob for Christmas”? Here are four that I will be looking for under the tree this year!

Being the avid reader that I am, I usually find myself this time of year making a list of books that I would like to read in the coming year. This makes it easy for my family members when they are trying to figure out “what to get Bob for Christmas”? Here are four that I will be looking for under the tree this year!