Thoughts from the desk of Bob Repass…

During the first half of this year, Eddie, Charles and I have attended many conferences and trade shows across the country. Our primary goal has been to develop strategic alliances with partners in the industry that will not only help take NoteSchool, Colonial Funding, and Colonial Capital to the next level but that will also foster relationships that we can leverage for our mentoring students to capitalize on as well. Nowhere has this alliance-building been more apparent than at last month’s Summer Summit where we had 17 different vendors in attendance, allowing for many networking opportunities.

As we’ve traveled across the country, I’ve been amazed at the amount of data now available. Data mining, for example, has become a whole new business in and of itself. The ability to aggregate and sell data has allowed our team to greatly improve our analytics and financial modeling. This is true on both up-front due diligence that we perform when pricing and bidding on deals as well as on the due diligence on assets once we have them under contract.

We have recently teamed up with Realty Pilot and are integrating several data platforms into our proprietary tracking system so we have everything on each particular asset from the time we receive it to bid on all the way through to the time we own it and service it through disposition.

As promised, we have also leveraged our partnership with Realty Pilot and are rolling out a program where our students can also manage their notes and or properties at a discounted rate of $2/property/month with full access to the Concourse 360 suite of applications at a discounted rate. By utilizing Realty Pilot’s robust Concourse 360 system and everything that it entails, we are now putting tools in the hands of our student/investors previously only available to the large institutional investors and banks.

Bob Repass

Managing Director

The Trading Corner

The Trading Corner

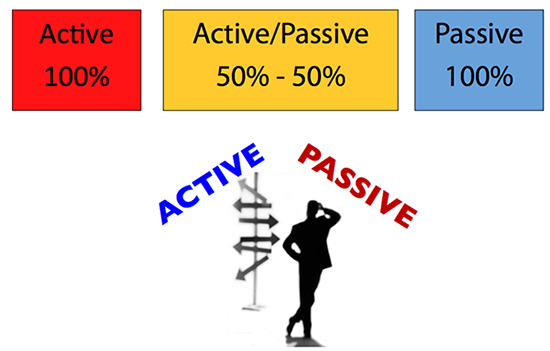

Active vs. Passive Investment Strategies – Which is right for you?

By Martha Speed

This is an important question to consider if you’re sitting on the sidelines watching and find yourself wanting your investment portfolio to grow… yet you’re somehow stuck in neutral. To move forward, you must take action in either an Active or Passive role as a Real Estate Note Investor, buying performing or non-performing Notes.

Picture this: two cars are driving down a three-lane highway. A red sports car darts between all three lanes trying to find the fastest possible way to get ahead. That’s me! A gray sedan is in the right lane, steadily going the speed limit; this sounds like Eddie. Suddenly, a train horn sounds in the distance, and the arm for the train crossing shuts down. Despite the red car’s best attempts for making up time, it’s missed the opportunity by a narrow window and comes to a screeching halt, right next to the gray sedan.

If driving the car were investing, the red sports car would be called Active Investing. The gray sedan, on the other hand, would be a style called Passive Investing. If you’re still unsure about which you prefer, here are some thoughts to help you decide which is right for you…

What do active investors do?

They take advantage of the market inefficiencies–in our world buying notes, loans secured by real estate–allowing them to buy and sell to make a profit. Active Investors spend an extraordinary amount of time trying to find the few deals that allow them to make extra profit. It’s work! This approach takes knowledge, time, and resources to manage assets and stay ahead. You might think of this as the driver in the red sports car weaving in and out of traffic making lots of stops and starts in an effort to get ahead on their own.

What do passive investors do?

Passive Investors also take advantage of market inefficiencies by participating in a portfolio, buying as many notes as possible in one fell swoop and allowing asset management or fund managers to complete the work and reallocate the assets back into the market at the most opportune time for short-term gain or hold for long-term gain. This approach obviously requires much less work and allows Passive Investors to stay ahead of the game. You might think of this as the gray car driving at different speeds depending on the speed limit.

Why should this matter to you? Because boring as it may be, a passive style of investing takes much less effort than the sexier, active style. Some people choose one over the other while others choose a “hybrid” of both. Why both you might ask? Choosing both allows you to optimize asset management, risk diversification and deployment of capital using your own resources as well as the resources of others.

Which style is right for you? Only you can answer that question. Are you the Active driver in the red sports car, the Passive driver in the gray sedan having a less exciting but steady ride, or are you interested in driving the hybrid, looking for a combination of both?

If you are not the do-it-yourself type Active Investor, need a combination of Active/Passive Investments or only want a Passive Investment approach, Optimize Colonial’s resources!

Call me at 817-410-4103 ext 117 and let Colonial put your funds to work for you on individual note deals or in Colonial’s Capital Management Fund!

Case Study

Sometimes Going to Foreclosure Sale Can Turnout OK

In this case study you will see why you always consider the cost and time of foreclosure into your potential expenses. In the overall picture of things, foreclosure is the least likely outcome, yet an investor always has to prepare for it.

On one of their first investments, Mentoring Students, Tom and Cyndi Buckley had to navigate their way through the imperfect investment world. In addition, the asset itself did have a number of non-redeeming qualities to begin with. The Buckley’s persisted, however, and they made a great profit at the end.

This note was secured by a vacant home in a rather remote location. After the Buckley’s ran the demographics, they decided to take a cautious approach and hired a local real estate broker to give them another opinion of value. The broker was confident of a $30,000 value especially since the property ended up being a 3 bedroom, 2 bath house instead of a 2 bedroom, 1 bath as indicated on the seller-provided BPO.

Tom and Cyndi purchased this note for $11,700. Afterwards, they had to clean up a fallen tree to avoid city fines. Since they were unable to locate the property owner, they hired an attorney to proceed with the foreclosure.

The property sold for $40,000 at the foreclosure sale netting the Buckley’s a $23,000 profit.

The Numbers

| BPO value of the single family home (collateral) | $30,000 | |

| Unpaid Principal Balance | $55,497 | |

| Note purchase price | $11,700 | |

| Purchase price % of value | 39.0% | |

| Purchase price % of UPB | 21.1% | |

| Servicing, insurance, cleanup costs | $1,885 | |

| Foreclosure cost | $3,200 | |

| Total All-in | $16,785 | |

| Proceeds from foreclosure sale | $40,000 | |

| Total profit | $23,215 |

Employee Spotlight

Employee Spotlight

Top Ten with Joe Varnadore

There are many people behind the scenes who drive the engine to make our companies successful. In our continuous Top Ten series, this month we turn the spotlight on one of these people so you can get to know them a little better. This month the spotlight is on Joe Varnadore, Director of REIA Relations.

How long have you been with Colonial Funding Group/NoteSchool?

15 months

What is your role at Colonial Funding Group/NoteSchool?

On the Colonial side, I price one off seller financed notes for our students. On the NoteSchool side, I work with Real Estate Investment Associations all over the US scheduling spots for myself and Eddie Speed to give our presentations on Non-Performing/Performing Notes.

Favorite Color?

Red

Favorite Food?

Lasagna

Favorite TV Show?

Suits

Favorite Movie of all-time?

Caddy Shack

Last Book You Read?

The Big Short by Michael Lewis

Favorite Sports Team?

Los Angeles Lakers

The 3 people you would like to have dinner with (dead or alive)?

Reverend Billy Graham, President Ronald Reagan, and Cecil Varnadore (my grandfather who died before I was born).

What do you like best about working at Colonial Funding Group/NoteSchool?

The people I work with on a daily basis: our students and my co-workers. I have never encountered a group of more positive, interesting, giving, caring, and hard-working people in my life!

Quote of the Month

“Everyone you will ever meet knows something that you don’t.”

– Bill Nye, The Science Guy

Survey Says…!

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?