Thoughts from the Desk of Bob Repass…

In some ways, December is a dichotomy, a division or contrast between two things that are or are represented as being opposite or entirely different.

I find my focus and attention divided. On one hand I am finalizing the current year’s priorities; i.e. , managing both pipelines we have of pending acquisitions, as well as loans we are selling, in order to maximize our velocity to best boost our capital fund investor’s returns along with ensuring we fulfill all the deliverables in our NoteSchool membership program.

While on the other hand, I am planning and forecasting for the upcoming New Year; i.e., setting our budget and sales goals, what capital requirements will we need, what market opportunities are we positioned to take advantage of?

Both are equally important and it is definitely a balancing act. As hard as it may seem you must find a way to do both. Handle the business at hand while keeping an eye on the future and charting your course for the year ahead.

Also be sure to set aside time to enjoy this holiday season with your family and friends. We all have a lot to be thankful for. My wife, Angie and I wish each and every one of you a Merry Christmas and a Happy Holiday Season.

We are looking forward to a great 2019.

Bob Repass

Managing Director

Stay up to Speed with Eddie

Solve Problems You Didn’t Know You Had – At A Mastermind

by Eddie Speed

I’ve been involved in masterminds for years, and I’ve taught classes for years. They both are essential to your success, but they’re two very different breeds of cat.

Before I went to a mastermind, I didn’t know what to expect. The first thing I learned when I took part in one is that a mastermind is something you take part in – not something you just attend. If you show up, you go up! Everybody is a student AND teacher.

In a class, the teacher explains to the students how to do something and unpacks it step by step. But a mastermind is a brain trust – made up of brains you trust. If two heads are better than one, imagine how helpful a whole room full of successful heads can be as everyone shares their wisdom.

But they don’t just share their wisdom; they also share where they need more wisdom. This requires transparency, vulnerability, and a bit of humility to seek guidance from other people. All of us are good at some things but none of us are good at everything.

Over the years, I’ve realized most businesses are built on five pillars. The typical business tends to have three solid pillars, but the other two are a bit shaky and keeping the business from reaching their next plateau (or five higher up). In a mastermind, there are sure to be people who are good at the things you’re not and people who can learn from the things you’re good at. By putting our heads together, everybody benefits from everybody else’s years of accumulated knowledge and success.

PEOPLE FIND SOLUTIONS TO PROBLEMS THEY DIDN’T EVEN KNOW THEY HAD

There’s something that surprises me over and over at masterminds, and it’s not just true for me, but also for virtually everybody who attends. What really puts the pepper in the pot roast is that you’ll find a solution to a problem you didn’t even know you had!

Here’s an example. A few months ago, we were having a mastermind with some top rock stars in real estate. I mean, these were people everybody aspires to become. One guy (a 25-year Veteran with a capital “V”) was listening to my wife Martha explain some strategies to boost profits (which our business has done routinely for years). He stopped her and asked her to repeat a small section of her presentation. Then his eyes bugged out, his jaw dropped, and he said: “If I had done that on my last deal I could have made four million extra dollars!”

Even though this guy is one of the best, he discovered a huge blind spot that wasn’t even on his radar. But it is now! He didn’t come looking for that plan in mind – it just unfolded. That’s what’s great about masterminds! What he learned that day will benefit his business for years to come.

Sometimes you go to the doctor because you know you have a problem, but other times you go for a checkup and the doctor finds a problem you didn’t know you had. It’s the same with a mastermind. They’re a great way to keep your business healthy.

COME TO A MASTERMIND WITH AN OPEN MIND

If you want to find solutions to your problems, you have to be transparent about your problems. I’m always impressed with a person who can talk about their struggles as openly as they talk about their successes.

As the proverb says, “He who walks with wise men will be wise.” A mastermind is not just another networking schmooze-fest where you shake hands and complement each other’s tie. It’s an opportunity to be around smart people whose careers are at similar levels, who cross-pollinate their ideas and raise each other up together. (It’s also a true bonding experience so you’ll definitely make lasting friendships!)

Ever wonder how an NFL team can win the Super Bowl one year but not reach .500 the next? It’s not because the rest of the league got so much better. It’s usually either a coaching problem or a communication breakdown. Communication is always the key to success for any team. When you attend a mastermind, you get to communicate deeply with people you trust. You quickly realize you’re all on the same team, and when one player improves the whole team improves.

You might not want to share your struggles with some stranger on the street, but you can safely share a personal issue that affects your business in our mastermind. It’s a chance to learn and a chance to teach; a chance to inspire others and be inspired.

Check out noteschool.com/notepro website for masterminds coming up soon. I know you’ll benefit in ways you never expected.

Marketpulse

A Big Buckeye Blowout!

By: Jeff Watson – Reprinted with Permission

I am a huge fan of the Ohio State University football team and their marching band. Not that I have much musical aptitude, but I do appreciate the amazing choreography displayed when that band does their famous script Ohio. I want to tell you about something I witnessed when I attended the recent Ohio State thrashing of “that team up north” and how we can apply it to our lives.

Due to the extremely good seats my good friend John Cochran and I had, we were able to observe two former Ohio State players (J. T. Barrett and Eli Apple, who now play for the 10-1 New Orleans Saints) join some of their other graduate friends on the sidelines to root on their alma mater. I’m sure alumni who are now in the NFL coming back to support their friends and college team for big rivalry games is a frequent occurrence; however, what stood out to me was not only how both J. T. Barrett and Eli Apple easily socialized with members of the training staff and current players, but how they were among the first to congratulate the Buckeye players coming off the field after they made a tremendous play.

How motivational and inspiring must that have been for these young college players to be met on the field by men they look up to who now have successful careers in the NFL, yet they were there cheering them on in the game! I thought it demonstrated terrific leadership and team spirit.

Let’s apply this to our lives. Who is in your life today who could greatly benefit from your praise and encouragement? Who looks up to you and can be inspired by you to achieve bigger, better and greater things than they thought they could do? You and I have a duty to find those people in our lives and do something to encourage, motivate and help them do better in their business, career, investing or life in general.

Take a moment and think of two people you can reach out to right away and encourage them in whatever they are doing in their life, business, or other endeavors. I welcome your thoughts and feedback.

Capital Markets Update

The World of Alternative Investments

By: Ryan Parson

Most people have a good understanding of traditional investments – stocks, bonds and cash – and either own these investments directly or through registered investment companies – a fancy phrase that includes mutual funds, exchange traded funds, closed-end funds and unit investment trusts.

In fact, registered investment companies are so popular that today they collectively hold over $18 trillion in assets on behalf of more than 90 million retail investors. And shockingly there are over 15,000 mutual funds alone! Yet there is an entirely different world beyond registered investment companies that investors need to know about.

A Simple Definition

An alternative investment is an asset that is not one of the conventional investment types (stocks, bonds and cash). Examples include venture capital, private equity, hedge funds, real estate, commodities, precious metals, rare coins, wine and art, among others. One significant appeal of alternative investments is that they usually have low correlations to traditional assets, which helps with diversification by lowering risk and increasing return potential.

The flip side is that alternatives are often less liquid (i.e., more difficult to buy/sell) and can be quite complicated – so not every investor can access.

Liquid Alternatives

Liquid alternatives – or liquid alts – are alternative investment strategies that are available through vehicles such as mutual funds, ETFs, and closed-end funds. The reason they are described as liquid is because they allow investors to buy and sell daily – whereas other alternatives usually allow for buying and selling at prescribed (and infrequent) times. The world of liquid alts is large and growing.

Private Equity

Did you know that there are actually more private companies than public companies? And many of them accept investor capital. Private equity is a very broad term that covers the entire investment spectrum of the private capital markets. And there are different private equity firms specializing in a lot of different investment strategies.

Private equity firms typically raise money from both non-institutional and institutional investors and use the money to place investments in what they consider to be promising private companies. Private equity firms and their investors then receive their investment– hopefully with a healthy return – upon an event such as an Initial Public Offering (IPO) or acquisition.

Private equity firms do receive a management fee much like mutual fund portfolio managers. In addition, private equity firms usually receive a performance fee. In overly simple terms, look at it this way: Portfolio managers of mutual funds pool shareholder’s money and invest in publicly traded companies, thereby allowing their investors to buy and sell mutual fund shares daily. Private equity managers also pool their shareholders’ money, but they invest in private companies and do not allow their investors to buy and sell their private equity shares daily.

Venture Capital

This is a subset of private equity specializing in investing in companies that are in the early stages or what is often called the early-growth stage. This capital source is very important for start-ups that have no access to public or bank financing and is typically a risky asset class, although it can produce outsized returns.

Direct Investments in Start-Ups and Private Companies

Investors can skip the private equity firms and invest directly into start-ups and private companies. Investing “seed capital” directly in start-ups is sometimes referred to as angel investing. But despite its name, angel investing is a high risk and high return strategy for investors as most start-ups end up failing. Many private companies will seek investors through a private placement based on a certain valuation. The challenge for investors is determining the validity of the valuation because the valuation is often calculated by the owner of the private company.

Private Placement Debt

Investment in private placement debt is a very large market in the alternatives space. Recently, new issues of private placements amounted to over $50 billion, compared with more than $1 trillion in the public corporate bond market, according to Macquarie. Similar to private placement equity, private placement bonds are not issued or traded publicly and are not required to be rated by a credit rating agency.

Real Assets

Real assets are tangible assets that have intrinsic value (hence the “real”), such as real estate, oil, precious metals, and commodities. Luxury and collectible goods also fall into this category, including antique cars, art, wine, jewelry, rare coins, and baseball cards. Investors can buy real assets directly or through a manager specializing in real assets. The challenge, as you might imagine, is that real assets are not necessarily liquid and valuations are often challenging to determine. For example, just because I buy 5 rare coins for $100,000 that does not mean that the coins are actually worth $100,000. Remember the old adage: something is worth what someone else is willing to pay for it? Not necessarily what I paid for it.

Hedge Funds

Hedge funds are similar to mutual funds in that they are pooled investment funds that are formed to invest in a variety of strategies and asset types. Hedge funds are different from mutual funds in that hedge funds often employ “riskier” investing strategies (at least compared to traditional thinking) – like leveraging, selling short and using derivatives. It is important to note that hedge funds are generally only accessible to experienced investors – called accredited investors – in part because there is less regulation when compared to mutual funds. Hedge funds are most often established as private investment limited partnerships that are open to a limited number of accredited investors, require a relatively large initial minimum investment, often require investors keep their money in for at least one year, and require that withdrawals may only happen at certain times.

Due Diligence

Private and Alternative investments require a different type of due diligence than you would ordinarily conduct on a traditional investment. While the basic framework of conducting due diligence is the same for both, it is imperative that investors perform their own rigorous and independent due diligence so that the risks and rewards of alternative investments are fully understood. This rests not just with the deal itself, but the due diligence within the scope of goals of your portfolio. In other words, an investor needs to make sure that beyond viability of the deal itself that it can produce the necessary cash flow, tax advantages or growth, just to name a few.

And Finally

As with any investment portfolio, creating diversification is a critical component to success. Although there is no exact science to creating diversification with traditional or alternative investments, perhaps it begins with understanding these various classes of alternatives. Each brings their own risk and strategic opportunities. If you have a solid perspective on what the needs of your wealth are from an income, growth and preservation standpoint, these alternative investment structures may just be the types of capital placement opportunities that balance the risks associated with traditional investments.

Alternative investments have become much more popular over the past decade, in part, because investors, both large and small, find the risk of traditional stock market investments to be too great. While alternative investing certainly comes with risk, the shift towards alternatives reflects the ‘risk-mitigating’ factors believed by most investors to outweigh the purported benefits of traditional investment selections. There is no ‘right mix’ answer or a one size strategy that fits all. It’s incumbent upon each investor to know their portfolio, know themselves, and stay educated about the evolving marketplace and learning new and the best ways to manage and ascertain opportunities.

Special Feature

Replay NoteExpo 2018

The note industry’s conference of the year NoteExpo was held November 2nd & 3rd in Dallas and by all accounts it was another successful event! But don’t just take our word for it, now you can experience it for yourself.

The video replays are now available for download. All main stage presentations from the opening keynotes, the panel discussions, general sessions and the popular NOTE Talks are all included. AVAILABLE HERE

I recommend getting your highlighter and note pad out and be ready to “chew on” some of the ways to develop your note business along with your entrepreneurial spirit and real estate investing knowledge.

Whether you were there and witnessed it all first-hand and just want to take a longer deeper dive into your favorite sessions or if you were unable to make it this year, you will benefit from being able to replay NoteExpo 2018 as often as you like. The content is both educational and inspirational.

And remember to keep up with the latest news on what will be happening next year at NoteExpo 2019, be sure to follow NoteExpo on Facebook, Twitter and Instagram!

In The Spotlight

As 2018 winds down, I would like to extend a very special Thank You to each and every member of our team. There are a lot of folks behind the scenes that make our companies successful. I am confident we have the very best people in our industry and I would like to recognize all of them this month. We are very fortunate to have a great team of employees.

Executive Team: Eddie Speed, Martha Speed, Bob Repass, Charles Mangan, Susan DeLaGarza and Ryan Parson

Executive Support Team: Debbie McMinn, Jeanna Clifford and Adam Dozier

Trade Desk Team: Angie Repass, Nathan Cheung, Scot Tyler, Tracy Rewey, and Mark Jamlech Santos

Asset Management Team: Linda Risk and Matthew Edwards

Customer Fulfillment Team: Riley Goff, Jesse DeLaGarza and James DeLaGarza

Sales and Business Development Team: Duane Gibbs, Ben Haught and Jesse A. DeLaGarza

Curriculum and Liaison Team: Joe Varnadore, Czarina Harris, Kevin Moore

Quote of the Month

“The American Dream means giving it your all, trying your hardest, accomplishing something. And then I’d add to that, giving something back. No definition of a successful life can do anything but include serving others.” – George H.W. Bush – 41st President of the United States

This Month’s Poll Question

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?

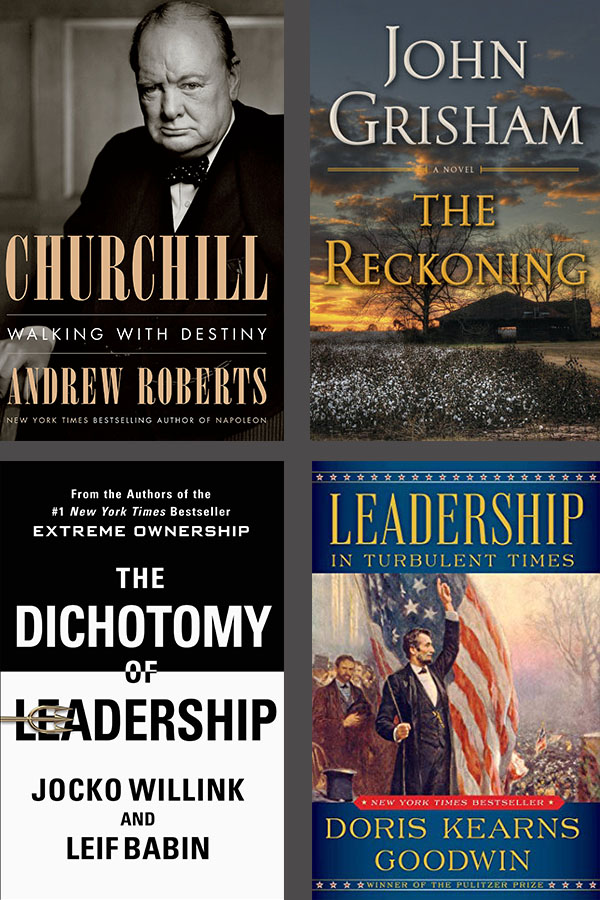

The obvious question this time of year is “What do I get Bob for Christmas?” Most folks know I love to read, especially when traveling. I also like to read a variety of different books. I always like to “escape” with some great fiction so on my list this year is John Grisham’s latest The Reckoning. I also read at least one biography each year, so I am looking forward to tackling Churchill: Walking with Destiny. Finally, I like to read books that relate to leadership, motivation and inspiration. Two books are on my list this year Leadership in Turbulent Times along with The Dichotomy of Leadership. I am thinking these four will be under our Christmas tree this year.

The obvious question this time of year is “What do I get Bob for Christmas?” Most folks know I love to read, especially when traveling. I also like to read a variety of different books. I always like to “escape” with some great fiction so on my list this year is John Grisham’s latest The Reckoning. I also read at least one biography each year, so I am looking forward to tackling Churchill: Walking with Destiny. Finally, I like to read books that relate to leadership, motivation and inspiration. Two books are on my list this year Leadership in Turbulent Times along with The Dichotomy of Leadership. I am thinking these four will be under our Christmas tree this year.