Thoughts from the Desk of Bob Repass…

Thoughts from the Desk of…

This time of year is Graduation Season. I’m always interested in the words of wisdom high profile people give to graduates in the Commencement Addresses. This year in particular, I noticed a wide range of all kinds of advice being offered by leaders in today’s business world and how some clearly contradicted others.

For example, Laura Alber, CEO of Williams-Sonoma says “Be committed. Dig in. Don’t treat your first job (or second or third) as a temporary stop.” While on the other hand, the CEO of Kayak, Steve Hafner suggests “Job hop, you’ll be better for it.”

Great, more and more young adults will be entering the job market with mixed signals!

A recent WSJ article: A Wake-up Call for Grads focused on 4 traits (skill sets) employers look for in their new hires. As I was reading, I quickly realized that these could easily be applied to traits needed to be a successful entrepreneur and note investor.

COMMUNICATION: In the corporate world employers are looking for new hires with strong communication skill to work with clients rather than be stuck in the back office. Think about it from the entrepreneur’s point of view, how important to your success is your ability to communicate? I can tell you that the note business may not seem like it, but it is a people business. It is all about relationships.

LISTENING: This piggy backs right off communications skills. To be successful whether at your “day job” or as an investor, you have to excel at listening. That is the key to identifying and solving problems for clients.

NUMERACY: Sounds like a fancy word for the ability to understand and work with numbers. The successful note investors know how to work in Excel, analyze data and run queries in datasets that streamline both their acquisition and due diligence processes.

ADAPTABILITY: Do you find yourself stuck in a routine? Do you hate change? Today more than ever things change fast and in order to survive, the ability to learn new skills as your job or industry evolves is the key to succeeding.

Take a minute and do a short self-evaluation. Which of these four is a strength of yours? Which are you weak in? What can you do to improve in these areas?

Finally I would be remiss to write about graduations and commencement speeches without giving a BIG SHOUTOUT to billionaire investor Robert F. Smith who promised the graduates of Morehouse College that he’d pay off the entire class of 2019’s student loans! “On behalf of the eight generations of my family who have been in this country, we are going to put a little fuel in your bus… This is my class, 2019. And my family is making a grant to eliminate their student loans.” Watch it Here

There is no better advice than to encourage people to “Pay it forward!”

Bob Repass

Managing Director

Stay up to Speed with Eddie

What Every Seller Wants Is To Move To The Next Chapter In Their Life

by Eddie Speed

You can get a great deal even when you don’t get a great price. And even though every deal ends up on paper, the truly great deals don’t start out on paper.

A great deal might start out at the coffee shop, or the lunch counter, or the feed store, or wherever you can have a meaningful conversation with your seller to find out what matters most to them. Your first conversation is not about numbers; it’s about finding out what’s most important to the person selling the property.

You’ll learn where their pain points are and what they need to move on with the next chapter in their life. You’ll learn if they want to be closer to their grandkids, or if they want to buy an RV and tour the country, or if it’s a property they inherited and don’t want, or if they need money for their kid’s college, or if they’re getting a divorce. As much as you’ll hear real estate experts talk about how to run the numbers, never forget the importance of good old fashioned people skills. It’s a dying art that I’m determined to keep alive!

As real estate buyers, we can increase the price we pay if we get soft terms through seller financing. For example: low interest, no interest, deferred payment, long term notes, plus all the different kinds of clauses you can negotiate. It all comes back to what you can negotiate with the seller. That’s what tells you how good of a deal you made. I call it “dictating the terms of the deal” to the seller.

People bring deals to my doorstep all the time to sell them to me, so I get an inside look at hundreds of thousands of deals. I look over the terms of some of these deals and think, “Why did anybody agree to this?” Well, they agreed to it because the buyer understood their pain points, knew which tools could be used to put the terms together, then they presented their offer in a way that enabled the seller to move on with the next chapter in their life.

A seller is almost never going to dictate the terms the way they dictate the price, so they’re open to soft terms. People are naturally used to a bank dictating the terms to them instead of the other way around, so there’s a lot less pushback. I’ll often ask a seller, “Why did you agree to zero interest, or no down payment?” And they’ll say, “Well, the guy gave me what I wanted,” which means the buyer did a good job of finding out their pain points, then structuring the deal around meeting those needs.

How can you dictate the terms to the seller? I’ll break it down into two steps.

Step 1: You have to have a good interview with the seller. That’s where you learn what’s most important to them. You have to use some discernment because at first it’ll sound like there’s no room to negotiate. But you’ll figure out how to peel off one or two essentials to focus on.

Once you know what the buyer really wants and needs – other than just their asking price – you’ll know which tools you’ll need later on in the negotiation process to put together an offer that the seller will accept. When you know which tools to use, you can negotiate a great deal without having to negotiate a great price, which the seller is probably not going to budge on anyway. You can architect a seller financed deal that gives them the price they want with the terms you want.

Step 2: Know what you’re negotiating for. There are so many things to negotiate that you can get lost in the details and lose sight of the big picture. As you put together a deal that meets the needs of the seller, you have to remind yourself what it is that you want to get out the deal. It’s easy to leave out important parts of the negotiation that benefit you if you don’t know what you’re negotiating for.

Out of the fifty or so tools in your seller financing toolbox, you’ll never need all fifty on every deal. But you will need fifteen or so on every deal. But which fifteen will they be? That’s why there’s wisdom in knowing what you’re negotiating for. If you try to bring out every tool you’ve got, then you’ll just confuse your seller and scare them off.

Once you understand the pain points of the seller and why they want to sell their property, you’ll be much better equipped at structuring a deal that meets their needs.

And your own!

Capital Markets Update

Creating and Preserving Wealth: A Practical Approach to Helping Aging Relatives Prepare for the Future

By: Ryan Parson

The best plans for managing the finances of an older relative are made when that individual is still healthy. Once stricken by illness, or frustrated by the loss of mobility and freedom, an older relative may not understand questions or be able to state details of their wishes. Fueled by the uncertainty of what the older relative really wants, the lack of a plan may ignite family arguments.

These talks should go beyond just discussing money to include subjects like the relatives’ future independence, decision-making regarding finances, health care, and preferences for day-to- day living.

Prepare for the conversation

While there are many areas of concern that will come to mind when you notice a loved one slowing down mentally or physically, you can’t address them all at once. Jumping directly into bank accounts, wills and powers of attorney usually stops the conversation. Talk about health and lifestyle issues first and then, when everyone’s comfortable, wade into finances.

Explain why you want to discuss finances. In some families, a successful financial discussion takes several attempts. Don’t get angry or discouraged: Many older relatives think this conversation threatens their way of life, and they fear judgment or losing control of their lives. Ask up front which topics are okay and which are off limits. Be willing to start the conversation at a later date so that you don’t upset your relationship. After some reflection, your relative may be more receptive to having the conversation. Once they get comfortable, relatives might be more receptive to talking about the off-limits topics.

Send questions beforehand.

This gives relatives a chance to prepare and the opportunity to say if they are ready to address certain areas. Basic topics could include:

- Is there a power of attorney? Is it medical or financial? Who has it?

- Where important papers such as a will are kept;

- How household expenses get paid;

- How to reach doctors;

- A list of medications;

- An advanced health care directive; and

- A funeral plan.

- None of these asks about dollars and cents but instead focuses on how the relatives live today and their plans for the future.

Offer to get professional advice.

Your relative’s advisor—if they have one—is a great place to start, as that person is likely aware of their situation and any decisions they’ve already made. An advisor can also suggest legal documents to put in place and ways to make sure both parties can access accounts to pay medical and household bills.

Plan a caregiving strategy.

Discuss your relative’s preferences and trigger points for various stages of heath care. Nearly everyone wants to stay at home, but you must talk about how much you can do at home as a caregiver and when to start services such as home health aides, geriatric care managers or assisted living.

Discuss what will happen with their home.

The equity in your relative’s home may become a way to pay bills. As homes are both major assets and emotional focal points, address what the relative wants to happen to property—and under what conditions.

Have a family meeting.

Once you’ve created a framework of a plan and identified roles and decision points, bring all the interested parties together. You and your relative can revisit the conversations and let everyone know the game plan. Family members may have questions or alternative ideas—or they may feel hurt if they were left out of the process. The reality is that these conversations are rarely easy. But with a proper roadmap, the conversations will be a lot less difficult, and you can improve outcomes for the people who matter in your life. Legal, medical, and financial professionals are all great sources of support for navigating these circumstances and conversations.

The Trading Corner

The Power of Validation

By: Tracy Z Rewey

How do you truly know whether a note is current or delinquent? You look at the payment history – preferably from a third party servicing company.

All notes listed on NotesDirect have a third party servicer in place. This provides independent validation of the payment history and account status.

When investing in notes it is also important to continue using a licensed servicer to manage the monthly payments. In addition to keeping track of the amortization, they will also handle compliance with laws relating to debt collection, transfer notices, year-end statements, and any escrows for tax & insurance.

When buying an asset on NotesDirect you get to select the servicer of your choice. To place the Purchase Offer you will need to enter your preferred servicing company. Often the current servicer is happy to continue servicing the note for a smooth transfer.

If you don’t currently have an account with a servicing company, you will want to contact them to establish that relationship before placing or closing on any offers. They will have paperwork for you to fill out including a servicing agreement and where to send your mailbox (or ACH) money.

Here’s a look at three recent asset purchases from the NotesDirect trading corner (all with third party servicing of course)!

Waco, TX Performing – Sold

BPO: $83,000 May 2018

UPB: $41,891 @ 4.5%, $221.41/mo, 331 months

Purchase Price: $23,000 (55% of UPB)

Discount: $18,891

LTV: 50%

ITV: 28%

Anticipated Yield 11%

Baton Rouge, LA Sub-Performing (BK) – Sold

BPO: $70,000 June 2017

UPB: $91,144 @ 9.4%, $825.23/mo, 257 months

Purchase Price: $50,750 (56% of UPB)

Discount: $40,394

LTV: 130%

ITV: 73%

Anticipated Yield: 19%

Dolomite, AL Performing – Sold

BPO: $94,500 Nov 2018

UPB: $56,524 @ 9.44%, $615/mo, 164 months

Purchase Price: $49,640 (88% of UPB)

Discount: $6,884

LTV: 60%

ITV: 53%

Anticipated Yield: 11.9%

Happy Note Investing,

Tracy Z Rewey

Quote of the Month

“Here you are. Accomplishing one of your dreams. It will be difficult, it will not look the way you want it to look, but in the end, if you stay focused, if you stay true, if you have the passion for your dream, you will get there.” – JJ Watt, NFL All-Pro – 2019 University of Wisconsin Commencement Speech

This Month’s Poll Question

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?

For a lot of folks, including me, summer is the prime reading season. It seems everyone has a summer reading list to recommend. Bill Gates, Oprah Winfrey and now, not to be outdone, me!

To be totally honest, I am finding it harder and harder to buckle down and read. My three prime reading times are when I’m on a plane, when I’m on vacation and on the weekends when I am sitting outside by our pool.

Now it seems more often than not, when I am flying, the plane I am on has the little TV in the back of the seat in front of me so I can watch a movie or TV show of my choice. Well this has sucked me in and I have found myself watching movies instead of reading!

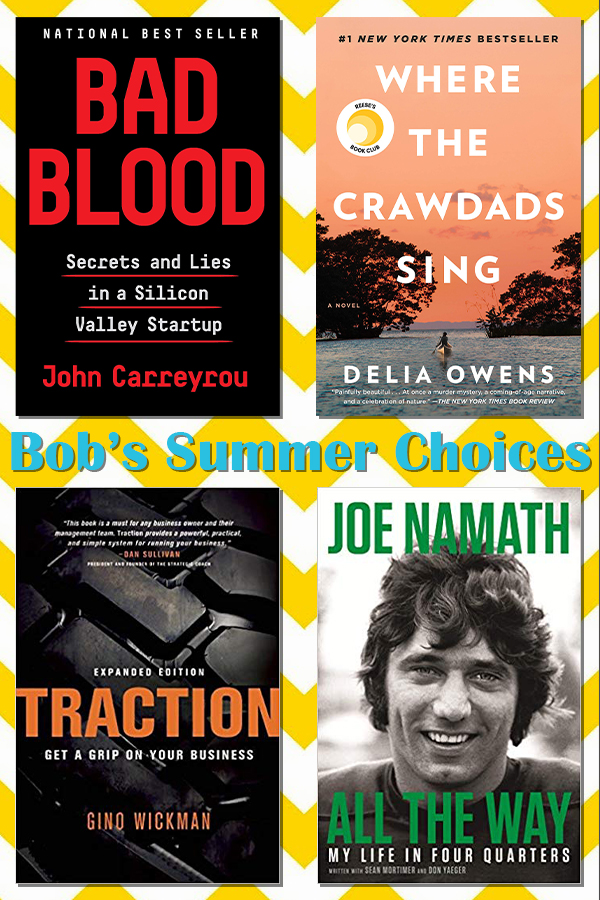

So I’m glad summer is here and I can get back outside by the pool and start reading. Here’s a look at 4 books that have caught my eye the first half of the year that I have on my list to read by Labor Day.

First up is Where the Crawdads Sing by Delia Owens simply because it has been on the New York Times bestseller list for the last 32 weeks. I am compelled to find out what all the buzz is about. Bad Blood by John Carreyrou has been on the NY Times bestseller list almost as long. I am intrigued by the rise and fall of the biotech startup Theranos. Next on my list is Traction by Gino Wickman. Eddie picked me up a copy of this book which lays out the “Entrepreneurial Operating System” to apply to our operations. I am excited to read Joe Namath’s new autobiography All the Way: My Life in 4 Quarters. Growing up, Namath, the quarterback of the Super Bowl II champion New York Jets was one of my heroes and one of the reasons I wanted to play quarterback. Now 50 years after his Super Bowl title he shares his life lessons from both his good times, as well as the bad times.

For a lot of folks, including me, summer is the prime reading season. It seems everyone has a summer reading list to recommend. Bill Gates, Oprah Winfrey and now, not to be outdone, me!

To be totally honest, I am finding it harder and harder to buckle down and read. My three prime reading times are when I’m on a plane, when I’m on vacation and on the weekends when I am sitting outside by our pool.

Now it seems more often than not, when I am flying, the plane I am on has the little TV in the back of the seat in front of me so I can watch a movie or TV show of my choice. Well this has sucked me in and I have found myself watching movies instead of reading!

So I’m glad summer is here and I can get back outside by the pool and start reading. Here’s a look at 4 books that have caught my eye the first half of the year that I have on my list to read by Labor Day.

First up is Where the Crawdads Sing by Delia Owens simply because it has been on the New York Times bestseller list for the last 32 weeks. I am compelled to find out what all the buzz is about. Bad Blood by John Carreyrou has been on the NY Times bestseller list almost as long. I am intrigued by the rise and fall of the biotech startup Theranos. Next on my list is Traction by Gino Wickman. Eddie picked me up a copy of this book which lays out the “Entrepreneurial Operating System” to apply to our operations. I am excited to read Joe Namath’s new autobiography All the Way: My Life in 4 Quarters. Growing up, Namath, the quarterback of the Super Bowl II champion New York Jets was one of my heroes and one of the reasons I wanted to play quarterback. Now 50 years after his Super Bowl title he shares his life lessons from both his good times, as well as the bad times.