Thoughts from the Desk of Bob Repass…

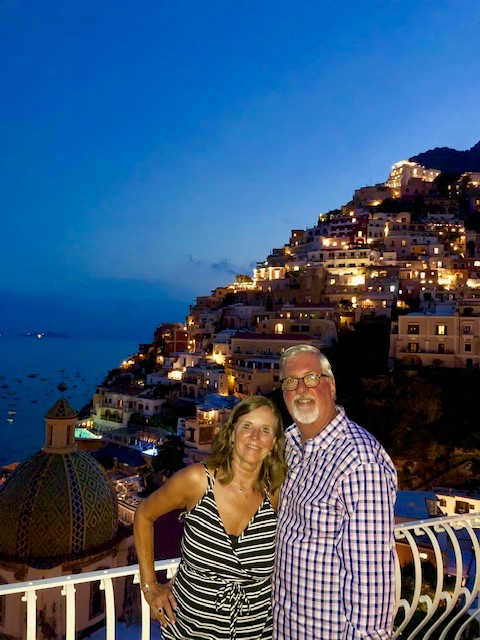

Angie and I just got back from spending 10 days on vacation in Italy. We spent time in two of our favorite places, Tuscany and then Positano, on the Amalfi Coast. Usually after vacation I talk about the value of “disconnecting,” but this year it seemed like the theme was more about “recharging.”

In today’s world, can you truly disconnect? Even when you are halfway across the globe, there are still Wi-Fi connections for your phones and tablets. Plus there is always the inevitable thoughts of the “mountain of stuff” waiting for you when you get back if you don’t at least stay somewhat connected.

So this year I focused on setting boundaries on when and how often I would check emails just to put out any fires that came up while I was gone. The 7 hour time difference between Dallas and Italy helped create a buffer as well.

Just take a look at some of the words and phrases associated with recharging; “to refresh or restore,” “to revive or restore energy, stamina enthusiasm,” “to revitalize.” Think it about it, don’t we all need to dedicate time to recharge?

The Indian industrialist Gautam Singhania says “The breaks you take from work pay you back manifold when you return because you come back with a fresher mind and newer thinking. Some of your best ideas come when you’re on vacation.”

When was the last time you took time to recharge? Recharging will look different for all of us. You don’t have to go to Italy to recharge, although I highly recommend it! Maybe it’s just a long weekend or a particular day each month.

I recently had dinner with a friend of mine who just returned from 5 days of camping and fishing with a close friend of his on a remote lake in the Upper Peninsula of Michigan. He described the feeling of peace that came over him on about day two when he realized that this time to recharge was just what he needed. Which reminded us of the saying “I love places that make you realize how tiny you and your problems are.”

It is hard to believe that it is already August and there are only 5 months left in 2019. As the cliché says “where does the time go?” Are you recharged and ready to finish the year strong? Where are you tracking on hitting your goals this year? Have you purchased the number of loans you planned to this year? Have you invested in your retirement and gotten a few steps closer to building your wealth for the future?

Are you keeping your finger on the pulse of what is going on in the real estate investing and note industry? Well, if you’re reading this Buyline, you’ve taken at least one step in that direction! The other step you need to take is to make sure you are registered for the note industry event of the year NoteExpo 2019 being held in Dallas on November 1st & 2nd.

I hope to see there and recharged and ready to go!

Bob Repass

Managing Director

Stay up to Speed with Eddie

Everything is Simple Once You Learn How

by Eddie Speed

Think back to the first time you rode a bicycle or played golf or went bowling or played an instrument or used a computer. At first, it was more frustrating than fun. Nobody’s good at a new skill the first time you try it. I admit, the day I found out I needed to use a computer was not a good day.

Everything you do is a result of something being worth the trouble of figuring out. It’s easy to decide that learning a new skill just isn’t worth the effort, so why change? I’ll bet you know some old timers who never bothered to learn how to use email or a smartphone, and the world is passing them by.

You know who has a lot in common with that old timer? It’s the real estate investor who thinks it’s too much trouble to learn creative seller financing. It won’t be long before the real estate world passes him by.

LEARNING + EFFORT = SUCCESS

Whether your goal is to be able to play the guitar or structure a seller financed note deal, there are two parts to reaching every goal: Learning and Effort.

As for the Learning phase, it makes all the difference if you have a teacher who is already an expert that can show you where to put your fingers on the fretboard to make a G-chord. They offer instruction plus something every bit as important––encouragement to get you through the early learning phase. Their encouragement is a placeholder for the enjoyment that will come later after you get over the hump.

The Effort phase comes when you have to practice, which is why the world isn’t knee deep in guitar virtuosos.

Here at NoteSchool, we have the years of experience to offer instruction, and we encourage our students until they can take off the training wheels. Plus, we never stop offering encouragement once they become successful experts themselves as thousands of students have.

Even though we can teach someone fifty ways to carve up a deal, and offer all the encouragement in the world, one thing we can’t do for them is to apply the effort for them to make their first deal. We’ve led thousands of horses to water but there’s always a few that just won’t make the effort to take a sip.

We show ‘em lots of cool stuff! They learn the tools of creative financing, they learn about partials, and how to buy properties at a discount. They see oodles of financial leveraging techniques. We teach with classes, seminars, and free webinars. We show them how to resurrect deals out of their trash can to double or triple their closing ratio, and how they can make astronomical returns on their investment by reselling to a passive investor.

They see how it’s done, they hear case study after case study of how people just like them have put together successful deals to make money and build wealth, and their instincts tell them it’s a smart thing to do. They don’t question that it’s doable, and yet they never make their first note deal.

So why don’t they do it?

IF YOU WANNA MAKE A BUCK, YOU GOTTA GET OFF THE DIME

Every note investor’s first deal is a bit of a nail-biter––kind of like a skydiver’s first jump. You either step out of the plane or stay buckled in your seat and fly back to the airport.

To make your first note deal you have to step out of your comfort zone before you have much confidence. Large amounts of money are changing hands and you’re anxious to make sure some of that money ends up in your hands.

We each have to conquer our own personal monsters, and some we all struggle with are self-doubt, procrastination, and just being too busy.

How many people have huge gaps of time in their calendar they’re desperate to fill up? Nobody! To add one activity, you have to subtract something else. I’ve seen people who couldn’t give up watching TV for a few hours to gather the information to refinance their house and save $500 a month. Those Andy Griffith reruns are costing them a fortune!

The real questions is: Are you willing to make a dent in your calendar? I suggest you start by committing to 20 minutes of self-analyzation.

Sit down with a pencil and paper. Write your goals at the top, then draw a line down the middle of the page. On the left side list the obstacles to reaching your goals, and on the right side list the benefits of reaching them. If you give something up, what do you get? If it takes X amount of time to learn something, at the end of the day what’s your hourly rate?

I have a strong hunch that once you see it all written down, it’ll change the way you think about what’s important.

And when you change the way you think, it changes your whole life.

Capital Markets Update

Money Talks: Tips for You and Your Partner to Discuss Financial Difficulties

By: Ryan Parson

In our July newsletter, we addressed the importance of teaching your young children the value of money, focusing on key elements like bank accounts, savings, budgeting, and even mindset. Our bottom-line advice here is that it’s never too early to get started with encouraging good financial habits. This month, we’re extending that theme to relationships and looking at why it’s essential that couples set aside time to discuss finances when the going gets tough.

Don’t Put Off Discussions About Money

We’ve all heard the famous quote attributed to Benjamin Franklin, “Don’t put off until tomorrow what you can do today.” When it comes to discussing money issues with your partner, postponing the conversation until a later date is rife with potential landmines.

Like a beautiful garden that slowly gets overtaken by weeds if left unattended, problems on the financial front can become overwhelming if neglected for too long. To avoid this potential deterioration, regular discussions are necessary to ensure that your thinking is aligned both about the current as well as the future.

Researchers have found that financial arguments foreshadow divorce and are much more contentious in nature than quarrels about other topics. Fights about money can get heated and personal and often contain language much more unpleasant than other arguments. They also take a lot longer to get over. If you care about this person, it’s incumbent upon you to find a way to initiate the conversation in a positive way. Understand the Warning Signs

Be aware of the signals that you and your significant other are overdue for a conversation about money:

-

- Your partner’s spending habits or debt directly impact your ability to pay bills and/or save money for future plans (college tuition, vacations, retirement).

- You have concerns about your partner’s lack of financial discipline due to credit card debt, student loans, and/or the absence of savings or planning for the future.

- You’re planning to get married, considering living together, or combining finances in some way as you move forward together.

How to Have Effective Conversations

If you’re unsure how to start, use these tips to keep your conversations positive:

Avoid words or phrases that “trigger” negative emotions:

If you’re like me, I’ve always been leery of conversations that start with “We need to talk” or “There’s something I’ve been meaning to discuss with you.” These are phrases that tend to put me on guard and make me brace for bad news; know your audience and make sure you’re mindful of how you approach the topic.

Keep It Positive:

Focus first on shared goals and then discuss how you can achieve those goals together.

Avoid Being Critical:

Start with your own financial shortcomings and ask for help in finding a solution. This allows you to segue into discussing their struggles as well and shows that you are focused on finding solutions together versus starting a fight or being antagonistic.

Common Goals:

Focus initially on some of the values you both share and what you hope to accomplish together. Open-ended questions ranging from

- What are your hopes and dreams?

- What aspirations do we share and which are individual?

- What financial steps can you and I take to make our dreams a reality?

Be A Good Listener:

Often in tense situations, it’s hard not to instinctively steer the conversation or push our agenda, but now is a good time to commit to listening, offering encouragement, and asking questions. Encourage your partner to ask questions as well.

Wrap-Up:

Approaching the topic of financial concerns with respect and understanding allows you to avoid the pitfalls of a contentious altercation which not only puts you at odds with your partner but also rarely results in the desired outcome. More positive and mindful discussions will almost always result in a stronger relationship and make it easier to discuss financial matters moving forward.

As always, if you have questions about these strategies or need more guidance on how to talk about finances with your partner in a respectful and impactful way, we have a variety of resources through the Mile Marker Club which we would love to share with you.

To your financial success!

The Trading Corner

What’s Your Through Line?

By: Tracy Z. Rewey

Every good movie or book has a through line. It’s the connecting theme that pulls you through the story from beginning to end. The compelling reason essential to forward momentum.

Do you have a through line for your investing plan?

My personal investing through line is to create passive income that can be managed from anywhere in the world (with an Internet connection). Notes backed by real estate are part of that connecting theme.

If you are struggling with this, it’s easiest to start with the end game in mind and map backwards.

If your goal is to buy notes to generate cash flow, start by deciding on the amount you want to collect each month. Next break that into how many deals you need to purchase. It looks something like this:

My goal is to buy mortgage notes and generate $_________ of cash flow per month. In order to do that I will need to buy ________ notes with an average monthly payment of ______________.

Sample: My goal is to buy mortgage notes and generate $5,000 of cash flow per month. In order to do that I will need to buy 10 notes with an average monthly payment of $500.

You can buy more notes with a lower payment amount or fewer notes with a higher payment amount. Or you can buy a full and sell a partial for future cash flow. Or you can create notes and wrap an underlying.

But nothing happens until you take action.

Each month we highlight three assets purchased on the NotesDirect Trading platform. More than just numbers and analysis, it’s people just like you and me grabbing hold of their through line.

Hanover Township, PA Performing – Sold

BPO $60,000 May 2019

UPB $128,989 @ 6%, $793.44/mo, 336 months

Purchase Price $47,995 (37% of UPB)

Discount $80,994

LTV 215%

ITV 80%

Anticipated Yield 19.76%

New Orleans, LA Performing – Sold

BPO $147,000 October 2018

UPB $16,014 @ 10%, $171.13/mo, 183 months

Purchase Price $ 14,150 (88% of UPB)

Discount $1,864

LTV 11%

ITV 10%

Anticipated Yield 12.23%

Sebastian, FL Performing – Sold

BPO $95,900 May 2019

UPB $63,303 @ 8%, $516.30/mo, 256 months

Purchase Price $50,725 (80% of UPB)

Discount $12,578

LTV 66%

ITV 53%

Anticipated Yield 11.04%

Happy Note Investing,

Tracy Z Rewey

[email protected]

In The Spotlight

NoteExpo 2019

The 6th annual NoteExpo takes place November 1-2 in Dallas. NoteExpo 2019 is more than a conference, it’s THE industry event of the year! It’s the place where solutions are uncovered, ideas evolve and the future of the note industry is shaped.

We believe the two main components of any successful conference are Content and Connections. We are committed to bringing you cutting-edge content from a wide array of industry leaders as well as providing an atmosphere most conducive to making the connections that will take you and your business to the next level.

Two days, dozens of industry experts, over 30 vendors, hundreds of attendees! Plan on joining us by registering today and take advantage of the early bird savings that runs through August 31st.

Click Here to register and we’ll see you at NoteExpo 2019 November 1-2 in Dallas!

Quote of the Month

“The difference between successful people and really successful people is that really successful people say no to almost everything.” – Warren Buffett

This Month’s Poll Question

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?

Where the Crawdads Sing by Delia Owens has been at or near the top of the New York Times Bestseller list since it was published in August 2018. So I just had to see what all the hype was about. I have to admit, I went in a little skeptical but once I got about a quarter of the way through I was hooked. It was a great read with some interesting twists and turns. I definitely recommend that you check it out.

Where the Crawdads Sing by Delia Owens has been at or near the top of the New York Times Bestseller list since it was published in August 2018. So I just had to see what all the hype was about. I have to admit, I went in a little skeptical but once I got about a quarter of the way through I was hooked. It was a great read with some interesting twists and turns. I definitely recommend that you check it out.