Thoughts from the Desk of Bob Repass…

For many years, I have been an avid reader of the Wall Street Journal and without a doubt my favorite column is “House Call” published every Friday in the Mansion section of the Journal. Each week they feature a celebrity, actor, musician, or athlete who describes the childhood home they grew up in and the impact it had on their life.

Reading these each week exemplifies the various backgrounds successful people come from and show that no matter what you were born into, it is possible to achieve success in the world.

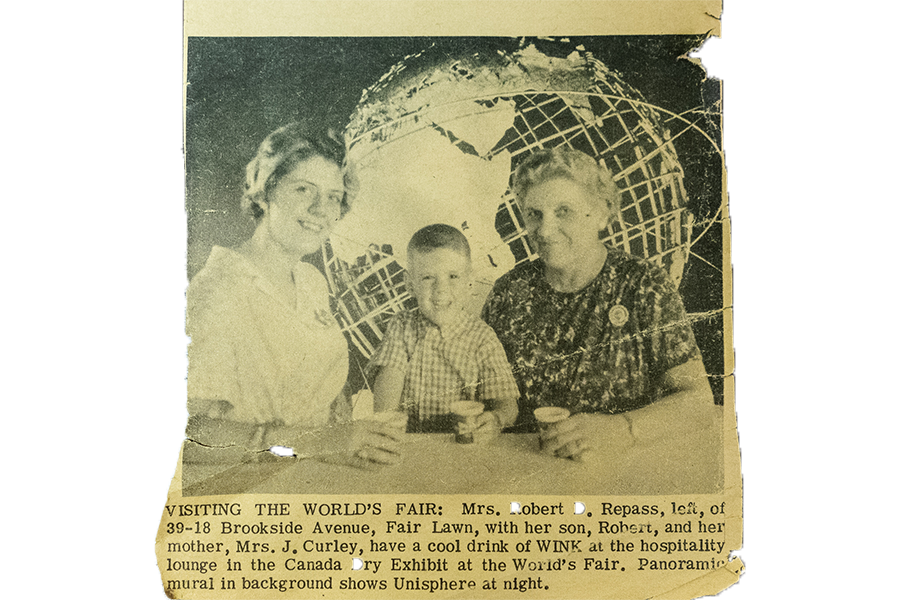

Some of you may not know this, but I grew up in Fair Lawn, New Jersey. My Mom, Dad and little brother lived in a 1750 square foot 2 story house with 4 bedrooms and 2 baths on Brookside Ave in Fair Lawn, a bedroom community of New York City.

Now maybe it makes sense why I’m a Yankee fan and, even though we moved before he came on the scene, a big Bruce Springsteen fan!

There are three memories that I vividly remember growing up in that house. First, I was probably around 5 years old and one morning I was following behind my mom as she went to answer the door. She didn’t realize I was right behind her and when she turned, the next thing I knew I had a burning pain in the corner of my eye, as the cigarette she was holding hit me right between the corner of my eye and the bridge of my nose. A few millimeters the other way and it would’ve been really bad news. I never saw my mom smoke again.

Then there was this one hot summer day when I was around 8 when I was outside in the driveway throwing a tennis ball up against the side of the house like I was pitching in the World Series. My little brother decided it would be fun to start spraying me with the water hose. My natural reaction was to run towards the front door as he chased me with the hose. While reaching for the handle of the door, I proceeded to put my right hand through the plate glass window of the storm door and off to the hospital we all went!

The last “incident” I remember from growing up on Brookside Ave took place down at the end of our block at Beaverdam Park where me and my Dad used to go down to the baseball field. He’d hit me ground balls and pop-flys and then throw me batting practice. I had a terrible habit of stepping away from home plate as the pitch came, afraid I was going to get hit. I remember my Dad yelling “Stand in there, I’m not going to hit you!” He then proceeded to throw the next pitch and hit me right in the shoulder. I’m still not sure if he did it on purpose or not, but I survived and the problem was solved. I was no longer afraid of getting hit.

Wow – thinking back on these, I guess I was lucky to have survived!

My Dad was a Regional Manager for a chain of “Five & Dime” retail stores (this was way before Walmart came on the scene) and he got transferred when I was 9 and we moved to Syracuse NY. We moved two more time in the next 5 years, first to Atlanta, GA, then to a small town in Eastern NC called Kinston. That’s where I went to high school before graduating and heading to Raleigh to attend NC State University.

That’s where I met my wife Angie and we lived in several places around Raleigh before moving to Dallas in 1997.

We have lived in the same home here for over 21 years. My favorite part is the pool area in our backyard. I am outside most of the time from early spring to the end of fall. This is where we raised our children. This is home!

Bob Repass

Managing Director

Stay up to Speed with Eddie

My New EBook Looks at Real Estate Investing Through a Whole New Lens

by Eddie Speed

One of my favorite movies was on not long ago. It’s called “Moneyball.” But it’s different from other baseball movies because it’s not really about baseball!

It’s about a revolutionary business model that completely changed the game. It’s the story of Billy Beane, General Manager of the Oakland A’s. People couldn’t understand why he kept his nose buried in statistics, or how he kept winning!

As I watched the movie, I kept thinking there’s something familiar about this story. Then I realized I’m doing the same thing in the world of real estate that he did in baseball!

His revolutionary approach to baseball inspired me to write a book about my revolutionary approach to real estate investing: IT’S A WHOLE NEW BALL GAME WITH CREATIVE FINANCING.

Billy Beane looked deeper into the numbers and statistics than anyone who had gone before, and understanding those numbers gave him an advantage.

Thanks to my role at Colonial Funding and other note investment funds, I’ve personally analyzed half a million real estate deals. The right numbers make deals come together, and wrong numbers make deals fall apart. And there are more important numbers than just purchase price.

Most investors still play by the old rules; buy low, sell high, with a low ball cash offer. But you can still make money paying full retail––IF you structure a deal that buys the seller’s equity and pays them back with future dollars instead of cash today.

There are dozens of strategies in this book, plus eye-popping case studies where creative financing bridged the gap between buyer and seller to close a deal. And it shows how to make transactional income today and build long term wealth for the future.

Click the link for a FREE copy. You’ll also get free training with lots of case studies.

We’re not just changing how the game of real estate is played––we’re changing how the game is won!

Here is a link for a free copy of my book: A Whole New Ball Game With Creative Financing

Capital Markets Update

Andrew Luck, the NFL and Early Retirement

By: Ryan Parson

Why early retirement eludes most people

Indianapolis Colts quarterback Andrew Luck stunned the world when he announced his retirement from the National Football League at the age of 29.

But who doesn’t want to retire early? Unfortunately, if you’re like most people that desire is not aligned with your reality. There are a handful of reasons why early retirement might elude you. Some of the reasons involve how you handle money, but others focus on your mindset and expectations or on factors beyond your control.

For many, good money management means just paying bills on time and having a little bit extra left over at the end of the month. If early retirement is something that you are interested in, you need to think about how you can better manage your personal budget.

There are any number of reasons why early retirement may seem out of reach.

Overcoming bad habits

Focus on Saving

Saving consistently lays the foundation for early retirement. If you lack a credible, workable savings plan, you simply can’t afford to eventually retire early.

What you think you need to save must also be realistic. For example, if you’re 25 years old and hope to retire in 20 years, saving 10% of your pay each year probably won’t get you there. More likely you must save 25% or 30% of your pay – and even as much as 40% or 50%, depending on the income you are making and the retirement lifestyle you hope to achieve.

Evaluate Your Cost of Living

Often your budget is the reason you are not able to save money and your cost of living is simply too high to allow you to save the amount that would be needed to retire early.

If you are serious about implementing a savings plan, you may need to put a few of your dreams to the side for now – a late-model car, a second home, exotic vacations each year – so that you can prioritize saving and investing.

Sometimes, certain basic expenses consume a disproportionately high percentage of your income. Housing is a major offender here. Money you pour into your house – whether for the basic payment, utilities, repairs and maintenance or insurance – is often money you lose for early retirement.

Change Your Mindset

Living the good life can leave little room in a budget to prepare for early retirement. Such preparation means rearranging your finances to prioritize saving and investing.

Preparing for early retirement requires a distinct frame of mind and can require a large dose of mental discipline.

Avoid Distractions

Create a plan based primarily on your budget and commit to saving a defined amount of your income for as long as your retirement goal takes. Planning, though, takes concentration: If side ventures easily distract you, your intentions may be good, but your goals may always be out of reach.

Most of us enjoy hobbies for a necessary brief distraction and relaxation. If a hobby consumes too much time, energy and money, it can hurt your preparation for early retirement.

Make a Commitment to Yourself

Planning and saving for your retirement takes time. You can’t spend six months working toward your goal and then declare victory. You must maintain the intensity between now and when you do retire early – whether it be in 5 years, 10 years, or 45 years.

When Andrew Luck announced his retirement, he told the world that “I’ve come to the proverbial fork in the road. I made a vow to myself that if I ever did again, I would choose me.”

Well, Andrew Luck kept his promise and chose himself. You should, too.

To your financial success!

The Trading Corner

Ideas to Shape Your Note Future

By: Tracy Z. Rewey

Have you ever heard something and thought to yourself, “This is the idea that will change everything!”

NoteExpo is less than a month away and I’m confident it will be filled with many opportunities for these light bulb or aha moments.

It could be…

- Attorney Jeff Watson on using the Trust Agreement to both protect assets and increase profits with private lending and Self-directed IRAs.

- Martha Speed showing how partials can turn a small HSA account into millions (with profits tax-free and tax advantages for contributions).

- Grant Kemp turning the wholesale/rehab concept upside down with his creative application of the “sub to” wrap, and owner-finance strategy.

And that’s just a few of the speakers on the powerhouse lineup!

My personal goal in presenting this year is to help investors realize the size and potential of the seller financed market. With over 25.9 billion of seller-carry notes created in just 2018 there is untapped inventory ready to be harvested.

Until we have a chance to see each other in Dallas at NoteExpo on November 1-2, here are three recent note purchases from the NotesDirect trading platform to keep the inspiration flowing.

Augusta, GA Sub Performing Note – Sold

BPO $79,900

UPB $19,148 @ 9.9% $335.57 /mo with 78 months remaining

Purchase Price $14,360 (75% of UPB)

Discount $4,788

LTV 24% / ITV 18% / Anticipated Yield 20.48%

Liberty Hill, TX Performing Note – Sold

BPO $139,900

UPB $122,550 @ 10% $1450.72/mo with 147 months remaining

Purchase Price $106,005 (86.5% of UPB)

Discount $16,545

LTV 88% / ITV 76% / Anticipated Yield 13.07%

Ovid, MI Performing Note – Sold

BPO $73,500

UPB $29,541 @ 10.0% $300.35/mo with 207 months remaining

Purchase Price $25,405 (86% of UPB)

Discount $4,136

LTV 40%/ ITV 35% / Anticipated Yield 12.52%

Happy Note Investing,

Tracy Z Rewey

[email protected]

In The Spotlight

Last Call for NoteExpo 2019

We are literally just days away from NoteExpo 2019! All the pieces are coming together for another great industry event. Over the past month, I have had the privilege of being on 3 podcasts episodes talking not only about my career in the note business but discussing the origins of NoteExpo and an overview of NoteExpo 2019 which will be our 6th NoteExpo! So if you know Justin Bogard, Dan Deppen or Fuquan Bilal be sure to check-out their podcast episode.

Here is a small sample of what we discussed. One of the main topics we will address this year is Cybersecurity and how to prevent a cyberattack on your small business. The number of businesses that do not survive a computer attack each year is astounding. Our Keynote Speaker Brian Nichols with the firm Bakertilley will talk about how entrepreneurs and investors can protect themselves.

Along those same lines we are going to have a new Panel Discussion this year “How Technology is Impacting the Note Business.” We have an awesome line-up of speakers from all across the note industry and real estate investing world. This is a “can’t miss” event!

There’s still time to register for NoteExpo 2019 being held in Dallas on November 1st & 2nd. I want to see you there!

Quote of the Month

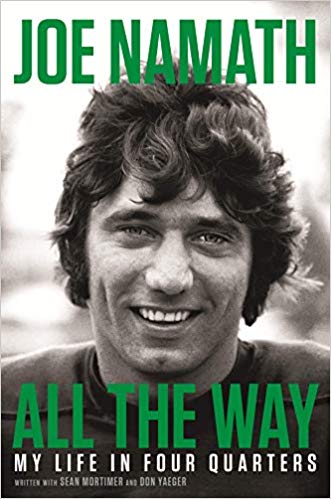

“If you’re not going all the way, why go at all?” – Joe Namath

This Month’s Poll Question

Connect With Us

Are you on Twitter? If so, be sure to follow us on Twitter @NoteSchool and @ColCapMgmt, if not, why not?

A new study says 27% of Americans haven’t read a book in the past year! When was the last time you read a book? Well I am just finishing up the autobiography of Football legend Joe Namath, “All the Way: My Life in Four Quarters.”

I grew up a big Broadway Joe fan. He was so cool. This honest recount of his successes, failures and triumphs puts so much in to perspective. His journey from growing up in Western Pennsylvania, going to College at Alabama and playing for Coach Bear Bryant to being the #1 Pick for the AFL’s New York Jets and all that media attention is a roller-coaster ride for sure.

A new study says 27% of Americans haven’t read a book in the past year! When was the last time you read a book? Well I am just finishing up the autobiography of Football legend Joe Namath, “All the Way: My Life in Four Quarters.”

I grew up a big Broadway Joe fan. He was so cool. This honest recount of his successes, failures and triumphs puts so much in to perspective. His journey from growing up in Western Pennsylvania, going to College at Alabama and playing for Coach Bear Bryant to being the #1 Pick for the AFL’s New York Jets and all that media attention is a roller-coaster ride for sure.